VRA Weekly Update: Record Fund Flows Into Equities, as Sentiment Flashes Greed. A Press Conference Like No Other.

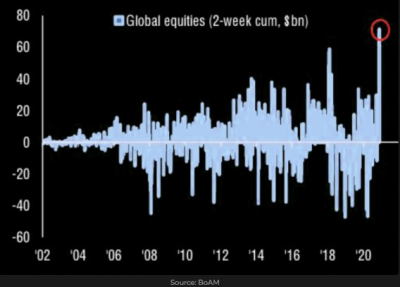

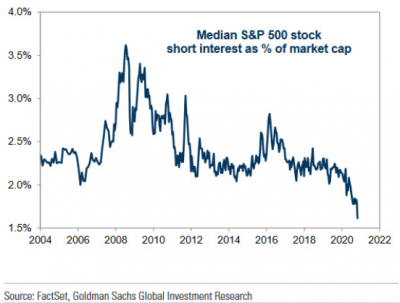

/Good Friday morning all. The public is coming back into equities in a big way, with global retail investors surging over the last 2-weeks to record inflows. At the same time, cash on the sidelines is plummeting as sentiment quickly flips from fear to greed, with short interest in S&P 500 stocks at the lowest levels in at least 16 years. FOMO, in all its glory.

Housing and transports continue to surge, continuing to point to a resurgent US economy. Whether Trump or Biden, DC gridlock looks to be firmly in place. That’s a major positive for investors.

At the same time, our markets are hitting extreme overbought levels…just as retail investors show back up to the party. Typically not a great short term recipe for higher prices. In fact, typically a clarion call for lower prices.

But these market internals…still very solid…are showing few signs of a several lower. We’ll get our first glimpse of future market weakness here.

So, what’s happening here? WFH (Work From Home) stocks…almost exclusive to Nasdaq…are higher, on the heels of our new round of CV insanity lockdowns, school closures and increased limitations that are building throughout the country.

And while its completely common for markets to climb a wall of worry, to us this feels like a situation that could quickly go the other way. The combo of markets hitting extreme overbought, the return of CV insanity and the very high likelihood (in our view) that election uncertainty is only going to dramatically increase, rather than decrease, in the days and weeks to come, points to the likelihood that a “risk off” environment could soon return.

VRA Bottom Line: while there’s no rule that says the markets must fall, even in light of these growing uncertainties, the smart money play is to proceed with caution. This could quickly evolve into a sharp sell-off. Our discipline demands caution.

A Press Conference Like No Other.

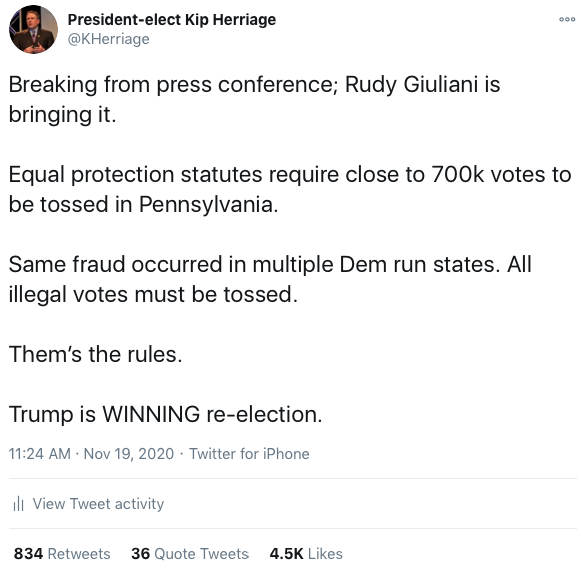

Following yesterdays extraordinary news conference with Trumps legal team…must have gotten 100 + emails, texts and DM’s from you…the onus is on them to win court cases.

If you were not able to watch the President's legal team, I can confidently say that no one alive has seen anything quite like what just occurred. It goes right to the heart of everything that is America, or maybe better put, everything that we thought America was. Surreal…frightening.

Here is the thread: https://twitter.com/KHerriage/status/1329475707144204292?s=20

While the DC deep state establishment and their MSM lackeys give Trump no chance to win, how many times over the last 4–5 years has Trump surprised everyone with a victory? The correct answer is, more times than we can count.

I did notice one thing of interest overnight; Predict It (betting site) shows the odds of Biden winning fell from 91% to 86%. It may be nothing…but it might also be the beginning of a shift in sentiment among betters.

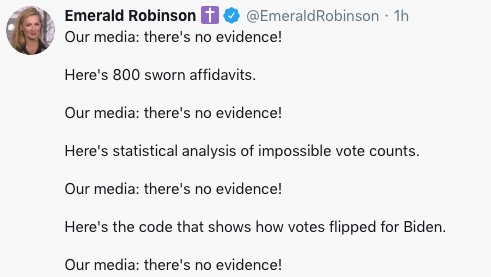

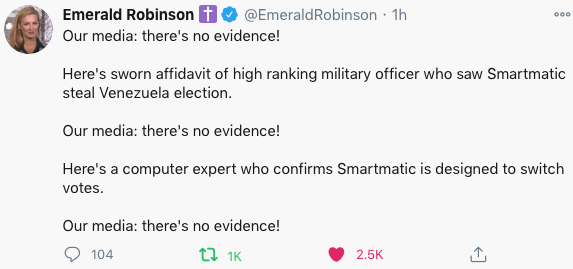

If you’re watching anything other than Newsmax or One America (including the now quickly shrinking Fox) you’re hearing the same chorus over and over; “but where’s the evidence??”

Newsman’s Emerald Robinson put those questions to the test this AM. You want evidence? Open your eyes.

For you Sidney Powell fans here…and we are many…here’s a must read piece on this remarkable individual, from someone that would know. While most everyone discarded a great man, General Michael Flynn, Powell aggressively stood by his side. Powell is an American Patriot. A true hero, in my book.

https://stream.org/i-know-sidney-powell-she-is-telling-the-truth/

VRA Commodity Watch

GDX (Miner ETF) is flashing a major buy signal on VRA System. Yes, the miners are equities, and could show some additional weakness with broad market weakness, but each time GDX has traded to this exact level in the well defined channel below has resulted in directional change. In addition, GDX is hitting extreme oversold, just as it also hits the 200 dma. The miners should move higher from here. Nows the time to add to positions.

Copper continues to ramp higher, now solidly at 2 year highs. We are adding to positions here as well.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter