VRA Investment Update: Disinflation Continues. Yes, This is a Bull Market. More Contrarian Buy Signals

/Good Friday morning all. Breaking; we just learned that the Fed’s favorite inflation gauge (core PCE) fell to 4.2% in March from 5.1% in February. This marks 8 straight months that we’ve had “disinflation”. With both US and European GDP reports coming in weak, we reiterate our call for the Fed to cease rate hikes and to begin cutting rates. The 10 year yield is 3.44% this AM while the Fed funds rate is 5%. The Fed never leads, they only follow. The markets are screaming at the Fed to “pause and pivot”.

VRA Market Update

Following a week of meandering and tepid action with leadership to the downside from two of our most important sectors (the semis and transports) we saw a rather extraordinary reversal higher in the markets yesterday with the Dow jumping 524 points and larger percentage gains from S&P 500 and nasdaq, up 1.9% and 2.4%.

We are in a new bull market. We will continue to use weakness to buy dips as we expect 2023 to be a (very) strong year, as evidenced by VRA Investing System readings in the technicals, analytics, leadership and investor sentiment. As Tyler reported on his podcast yesterday, 2023 has been the best year on record (to date) for “buying the dip”. AKA, the action you see in a bull market.

Q1 earnings are surprising to the upside, as we forecasted and expected. When co’s with market caps of $500 billion to more than $2 trillion jump 11–14% on earnings, you’re in a bull market.

One note to my post below; Amazon has since given up all of its 14% gains and is down 4% this AM. That means AMZN is only up 30% in to start 2023.

While we’ve not liked the action in semis, trannies and market internals of late, the semis are still up 20% on the year and the transports were up 2.6% yesterday. We want to see the transports perform better. More importantly is the fact that housing is leading higher. Bear markets tend not to take place when housing and the semis are leading higher. These market tells are highly correlated to a “risk on” environment.

More Contrarian Buy Signals; Professional Investors Avoiding Stocks

Hedge funds have their largest net short position in S&P 500 futures in 12 years (chart below). 90% will read this and believe it’s bearish for the stock market. Nothing could be further from the truth.

More fuel for the fire when they are forced to cover their shorts.

In addition, the Barron’s online ‘Big Money’ poll this past weekend showed that out of the 130 managers polled only 6% of their clients were bullish. Finally, as we reported last week, the BofA global fund manager survey shows that money managers are the most bearish on stocks, relative to bonds, since 2009.

These tend to be solid contrarian indicators.

VRA Bottom Line: we remain long and strong as we’re in the best year period (pre-election years are highly bullish). As always, we’re keying off of the semis. We have been aggressively long from the 10/13 bear market lows and will likely remain long into the end of April…quite possibly now, well into May/summer.

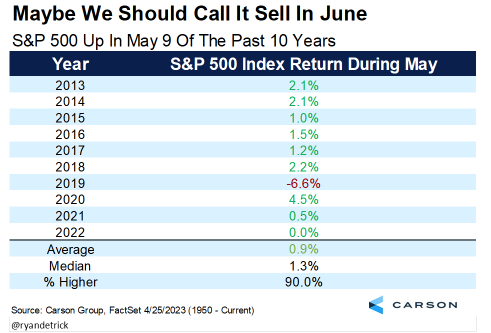

We have a target in mind for potentially taking profits on some of our ETF positions. It rhymes with “sell in May and go away”. May is not a great month for stocks, historically, however May has been higher 9 of the last 10 years. Seasonality may have missed the mark for April strength.

Sell in June and Go Away? As Ryan Detrick points out, stocks have gained in May in nine of the past 10 years.

Importantly, the S&P 500 is now six months past the bottom of a 20% + decline without revisiting that low for the 14th time since World War II. All but one of the prior 13 instances saw the S&P 500 higher six and 12 months later (beyond the initial six-month period).

Yes, this is a new bull market, if you are not long you‘re wrong.

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble