VRA Weekly Update: The Nature of Fear and Greed. AAII Sentiment Points to MUCH Higher Markets.

/Good Friday morning all. 7 trading days ago we were hitting all-time highs with our most overbought conditions since Trump was elected (put-call ratio, momentum oscillators and % of S&P 500 over 200 dma). Both Barrons and Forbes told us, on their covers no less, that Dow 30,000 is “a certainty and it won’t stop there”. Of course, they’re right about that…it’s just that both publications happen to have a reputation for ST top calling.

Here’s the bigger point; just over a week ago, every Wall Street trader and CNBC/Bloomberg expert told us “if only we get a pullback we’ll be all over it”. Now they get their chance. Doubtful they’ll take it. Most like buying high.

A 2.5% pullback may not sound like a lot but its also true that the average stock has fallen in the 8–10% range. VRA Bottom line: when the Dow is headed to 50,000 by the end of 2024, pullbacks in our favorite stocks must be bought. Make sure and login to your VRA Members Site to ensure you are positioned correctly.

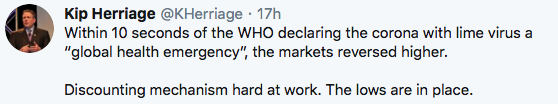

Tyler got into this on our podcast yesterday…the mechanics of fear and greed on the markets. Within seconds of the WHO declaring the coronavirus a global health emergency the Dow Jones bottomed and closed some 390 points higher off the lows.

Not that we can give you 100% assurance that we won’t head lower, but markets that rise on bad news almost certainly want to go higher still. The coronavirus is being compared to the SARS virus…here’s what happened to the markets when SARS was declared a global emergency; a 37% move higher over the next 9 months.

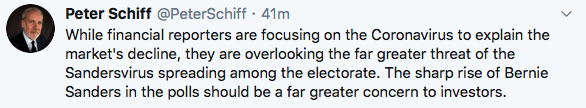

The question is, are we lower on coronavirus fears or the increasing likelihood that Bernie will be the Dem nominee? The Sandersvirus?

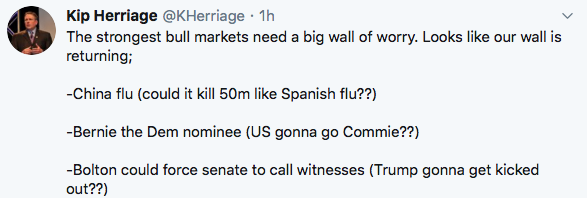

It’s certainly easy to see why the markets are lower…yes, the SARs virus/Asian flu/ebola’s of the past scared the sh*t out of the public and had a short term negative impact on global economic activity but come on; on CNBC earlier this week we had the coronavirus compared to the Spanish Flu. The Spanish flu only killed 50 million in 1918. Can our fake news MSM fear-mongering propaganda get any worse?

BTW, globally (on average) the flu hits 10’s millions/year with up approx 750,000 dying…

This is what happens at extreme overbought levels…

As you’ve heard us say often; bad things tend to happen in the markets when we reach extreme overbought levels. This is almost certainly just that…an extreme overbought pause (S&P 500 is up 15% since the end of August).

And we need that wall of worry….every great bull market does.

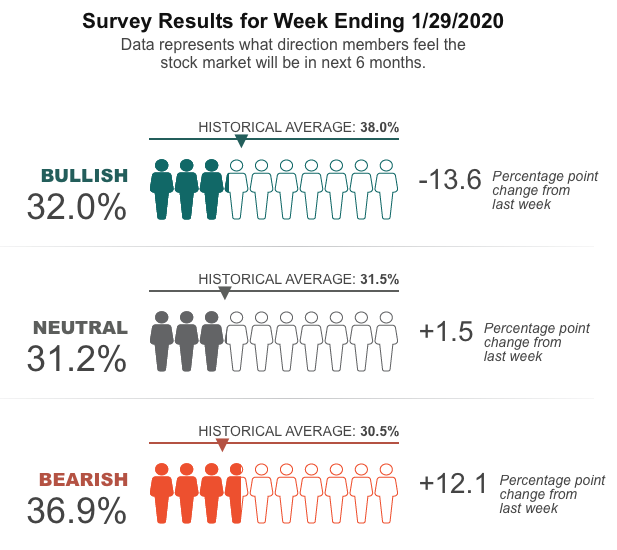

AAII Sentiment Survey

All it took was an 800 point decline in the Dow Jones for bullish sentiment to implode. Now just 32% bulls (-13% on the week) to 36% bears (+12% on the week). We’re a whopping 2% from ATH yet bullish sentiment is collapsing. Folks, we’ll know our markets are entering the danger zone when even the worst of news (yes, even worse than the corona with lime flu) barely impacts bullish/bearish sentiment. Bull markets get into trouble when investors start thinking that stocks cannot go down.

VRA Bottom Line: We will use overbought pullbacks to add to our positions and/or put new positions on.

Best advice…and I remember this from my mentors well…”when the public panics, you want to buy strength”. We know what’s led the markets higher (from the 12/18 capitulation lows); housing, tech/semi’s. These are the areas we will look to buy (in addition to existing positions).

Stay frosty… we’ll let the fear mongers do their thing….let’s make sure we’re among the smart money.

We want to act….rather than react.

Until next time, thanks again for reading…have a good week

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast