VRA Update: Markets Look to Finish the Week Strong. Big $19 Billion Dollar Hostile Takeover in the Mining Sector. W.A.R. NOW Interview.

/Good Friday morning all,

It is shaping up to be an exciting end to what has been a relatively dull week for our markets. We have seen small trading ranges for our indexes this week as the market and investors were looking for a clearer outlook from the fed and potential resolutions to China trade discussions. We look for these conflicts to be resolved and as we have said here often, never short a dull market, therefore, we must be long.

We received confirmation of the Fed’s pause this week in their February minutes, as the FOMC voted to keep its benchmark interest rate target at 2.25 percent to 2.5 percent, and indicating it will take a “patient” approach to further policy moves. Five more Fed officials are due to speak today, but should follow the report we received on Wednesday.

As for the trade talks, Trump is scheduled to meet today with China’s top trade official, Liu He, with only one week left to the March 1st deadline it is looking positive that both sides will make concessions that will at least continue the truce on tariffs so that further negotiations may continue after this deadline. As we have said for over a year, this was never a trade war.

The Shanghai (+1.91%) and Hang Seng (+.65%) are both up overnight here, pointing to a positive outlook from Asian investors. Our China buys are up over 4%.

All four U.S. indexes are also trading higher as I write, and this is an important day for our markets, as you can see from the chart below of the S&P 500, we remain at overbought conditions in nearly every category, but as we have said here long and often, there are few more bullish signals than a market that continues to head higher despite overbought conditions.

It is our continued belief that these are the pauses that need to be bought and these brief breaks are just what we need to keep our markets fresh, while also keeping the Fed from aggressively raising rates.

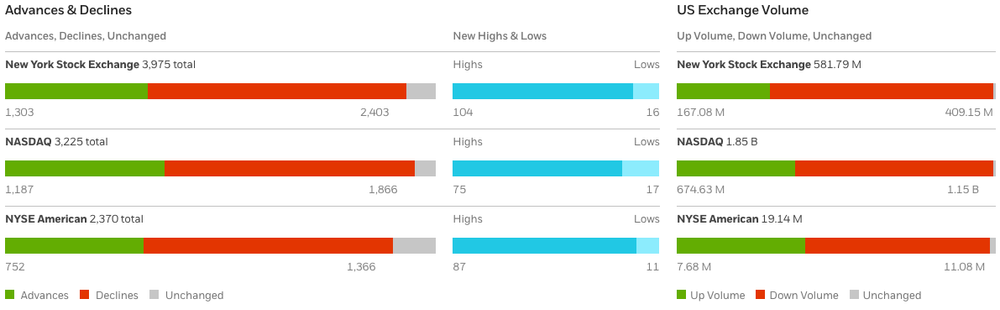

As you may have heard on Kip’s podcast yesterday (link), we did see our first day of negative Volume and Advance/Declines in our internals from some time now, but new highs to new lows still finished positive, and take a look at the internal charts below and they will tell you just how far we have come in such a short period of time since the December 24th lows.

As you can see here, Advance declines just hit a new all-time high on Wednesday, a key that we see as an important market tell which is, new highs begets new highs.

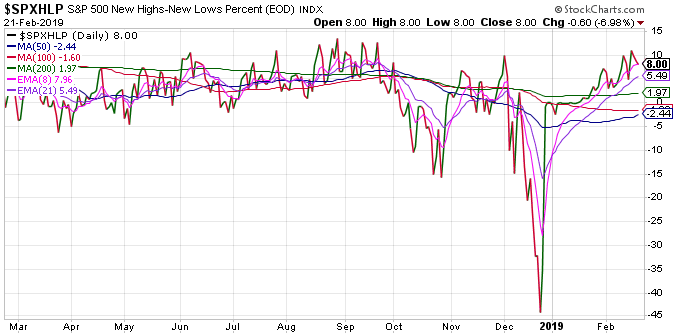

Percentage of S&P 500 stocks hitting new highs to new lows also now back rallying big back from the December 24th lows. This is the exact chart we looked at following the Decemebr 24th lows that told us the lows were in.

Bottom line: No one knows what is going to happen in the short-term, but we will continue to shout it from the rooftops, if you are not long, you are almost certainly wrong.

Gold

Big news from the mining sector as Canadian based Barrick Gold announces hostile plans to buy U.S. based Newmont Mining Corp for $19 Billion in one of the largest-ever mining deals.

After this gold rally which started in October, which has gold up nearly 12% since October 9th. This move has flown under the radar of most, but the movement in miners is even more impressive as GDX is up more than 26% in the same time period. Leverage is always 3–5 times higher in the miner

This piece of news makes it official, the mining sector is now red-hot! If you haven’t seen our research from earlier this week on gold and the miners, I encourage you to go back to our February 19th update and check out the incredible chart patterns we have seen in this sector. Gold is up marginally higher this morning, it has moved up right along with our markets over the last two months, and similar to our markets, we could see a little sideways action but this will be a precious metals break out.

Investor Sentiment

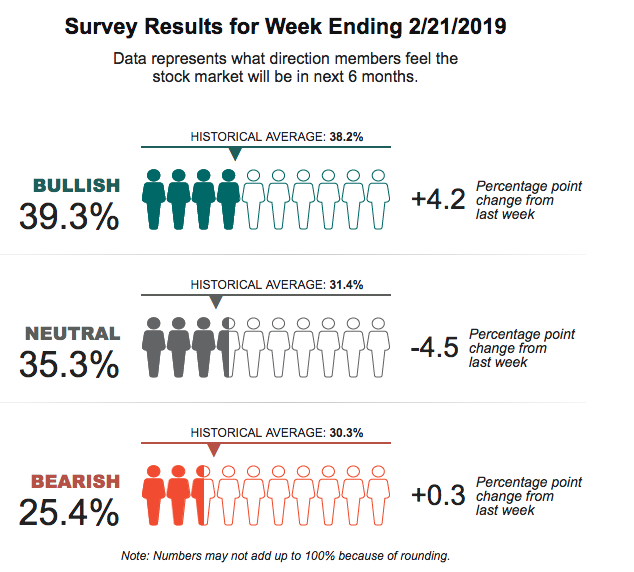

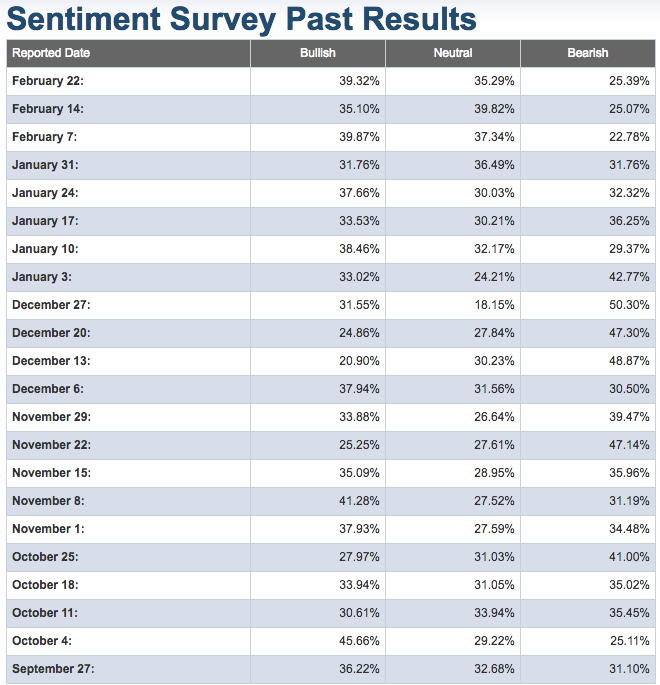

Investors continue to be on the fence about this market, take a look at the past few months of investor sentiment. Bullish sentiment is reaching the high end of the last few months worth of surveys, but we are nowhere near euphoric highs with bears/neutral investors still at 60%, while bullish investor sit at only 39%. We will say it again, this is just not how bull runs end, and it is our belief that sooner rather than later will be the time to break out of the sideways movement we have seen since the October highs and will send our markets back to new all time high territory

Finally, a big thank you to our great friend Wayne Allyn Root…aka WAR…for having me back on this week. In the segment prior to mine, Wayne was getting into his theory that the Mexican drug cartel has been a major source of funding for the Democrat Party.

The man is fearless. Always has been.

If you were with us here at the VRA in the days/weeks following the Las Vegas massacre, Wayne and I tag teamed the attack, exposing both the financial profits from 10/1 as well as the HIGH likelihood that ISIS was behind the attack.

But folks, I do not live in Las Vegas like Wayne does. Day after day, Wayne exposed the corruption that took place at MGM (owner of Mandalay Bay). Corruption at the very top of MGM, from both the CEO and Chairman. He did it in print (he writes a 2 x weekly column for the largest paper in Vegas) and on air (he has the #1 radio show in Vegas).

In fact, fearless is not a strong enough word to describe Wayne. Balls of steel and a possible death wish? Thats more accurate… :)

WAR is the freaking man. If you don’t already watch his nightly show on NewsMax or listen on radio, I can promise you he is far more interesting and accurate than anything you’ll see/hear on the networks.

You can find my complete interview here: https://soundcloud.com/user-640389393/kip-herriage-live-on-war-now-with-wayne-allyn-root-1

Until next time, thanks again for reading… have a great weekend.

Kip Herriage

So far in 2019, our average gain per postion is over 40%, nearly tripling the S&P 500! Come join us at the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

Since 2014 the VRA Portfolio has net profits of more than 2400% and we have beaten the S&P 500 in 15/16 years.