VRA Weekly Update: Impeached. Investor Sentiment Getting Frothy. Markets Flashing Extreme OB.

/Good Thursday morning all.

Yesterday President Trump was impeached in the House. Regardless of how right or wrong it may be, get ready for non-stop never-Trump MSM coverage and political ads with “Trump is only the 2nd president in modern times to be impeached”.

Whether or not it moves the needle for the elections next year, know this; the left missed on “Russia, Russia, Russia”, followed by the 2 year Mueller investigation. Complete whiff.

But they haven’t missed on impeachment. They got Trump on impeachment, a scarlet letter that no president wants to be marked by. In my view, shameful. Most voters appear to feel the same way. But how will the public feel after 11 months of non-stop media coverage reminding us of impeachment? That’s the question.

Regardless, the markets should only be fazed if polls start to show a sizable lead for one of the far left Dem candidates…in other words, any of them. More than anything, this should be a nice wall of worry for the markets to keep climbing. With investor sentiment getting more positive (finally) and with our more and more Wall Street shops and financial MSM predicting a’melt-up” (we beat them by 3 years with this prediction), things are getting a bit frothy. The contrarian in me getting just a bit nervous.

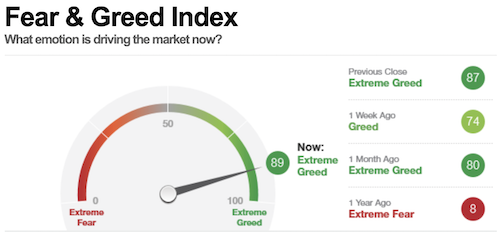

We see some froth in the Fear and Greed index, which has clawed its way back to 89 (extreme greed);

The weekly AAII Sentiment Survey is also out. Bullish readings now at the highest level since 2/18. Bearish readings at the lowest level since 1/18. As we’ve covered here often, the public is beginning to fall back in love again with stocks.

And who can blame them for being bearish forever…. from 2001–2016 was likely the worst 15 years in US history. 9/11, recession, ME wars, financial/housing crash, 2 year Depression, $4 trillion in QE with $13 trillion in added govt debt, destruction of healthcare, the opioid crisis.

Name a worst 15 year period in the US…not sure we can.

So it's natural for investors to distrust the markets…completely natural for investors to remain bearish…forever.

The Trump Economic Miracle is finally convincing investors that its safe to go back in the water. BTW, what impeachment??? The markets couldn’t care less…it’s not the news that matters most, but instead, the market's reaction to that news (as Tyler covered in yesterday's VRA Investing Podcast).

But…and here’s the but…with investors getting bulled-up, and with our markets beginning to red-line overbought, we are not adding to positions here or putting new ones on. It’s our discipline…it’s not a sell signal.

AAII Sentiment Survey. 44.1% bulls (highest reading since 2/18). 20.5% Bears (lowest reading since 1/18)

SEMICONDUCTORS FLASHING EXTREME OVERBOUGHT

Market timers know that tech leads the way and that the semis lead tech. Below is the 1-year chart of SMH (Semi ETF). Great looking ascending channel from early August. The semis have been a freight train. Today, they have reached the top of the channel…a pullback would match the channel pattern….with extreme OB readings in momentum oscillators. And this; SMH is now 21% above it’s 200 dma…highest OB readings in some time. Again, not a sell signal…we love stocks/sectors that reach OB and keep rising…but it does match our VRA views that a pause here should not surprise.

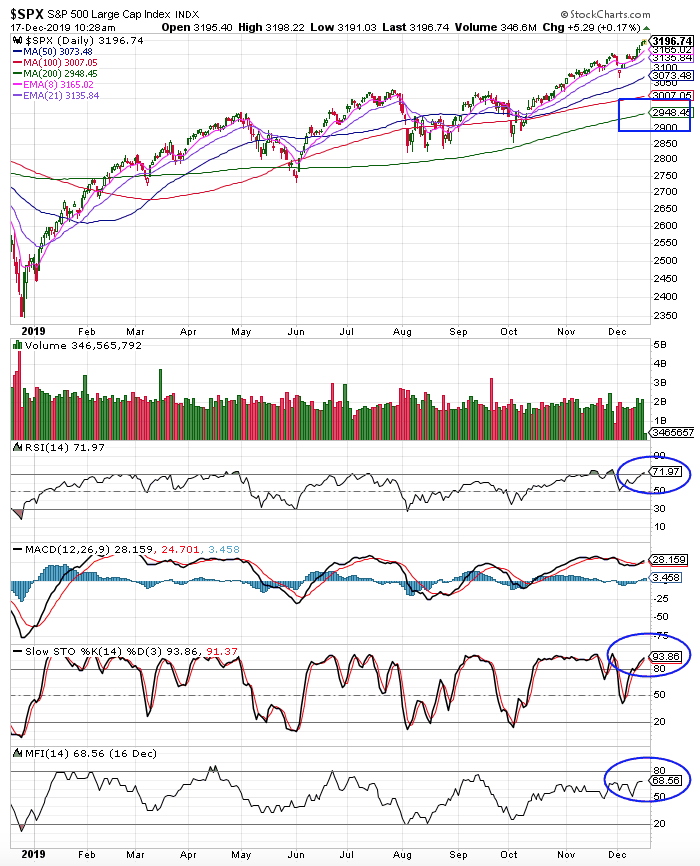

We also see it in the most important stock index/chart on the planet, the S&P 500.

Here’s what we see; we are hitting extreme overbought in RSI and Stochastics. We call it “redlining” and while it doesn't mean the markets have to drop, this IS when bad things tend to happen. Money Flows (MFI) have room to run…no issues there.

But this; as of this morning, SPX is 8.4% above its 200 dma, matching it’s greatest spread of the year. The last time SPX was this extended (July), it then fell 7% in 2 weeks. Our discipline prevents us from aggressively adding positions or adding to positions, with readings like this. We continue to buy pullbacks…should we get one. Not a reason to sell…just a time to be smart.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast