VRA Update: Transports hit all-time high, US-China Trade Deal. VRA Chart Analysis

/Good Thursday morning all. If you listened to our daily VRA Investing System Podcast yesterday (vrainsider.com/podcast or iTunes Podcasts. Always free, usually < 5 minutes) you heard what we believe is the advance playbook on a US/China Trade Deal. It’s coming…we continue to believe in advance of mid-terms.

VRA Bottom Line:

The US (Trump) invited China back for new round of negotiations. The invite from Trump allows China to save face, as they ultimately bend to Trumps will. Make no mistake…this is exactly what’s happening here. Chinas markets/economy have been hit HARD, all while the US economy/markets continue to soar. While the US media will be hesitant to give DJT credit, here at the VRA we know/report the truth. Trump has kicked China’s ass…entirely and absolutely.

The playbook from yesterdays trading was most enlightening, once the news hit. The US Dollar weakened, the Yuan strengthen, precious metals/miners ramped higher, US trade-centric industrials, deep value, including housing stocks, rallied hard, Chinese stocks jumped 2–3% (futures, then overnight) and US markets (Dow Jones) saw 200 points in gains (from -50 to +150) inside of 30 minutes. This is our advance playback. We are positioned well for it.

The US economy continues to roll…the Trump Economic Miracle picking up steam. This week the transportation index hit new all time highs, even as perma bears continue to scream “a recession is coming”. Each week, mainstream financial publications run a feature piece with dire warnings of economic fall-out, just around the corner. Last time I checked, when record amounts of products are being produced/shipped throughout the US, with an economy that is picking up steam, “recession” is not the first thought that comes to mind.

If you were able to listen to the VRA Podcasts this week (each day at market close, sign up at vrainsider.com/podcast) you hear Tyler’s description of small business growth that is ramping up from Tuesday. Small businesses are the heartbeat of the US economy, responsible for 70% of all job growth nationally.

Tuesday, the NFIB Small Business Optimism Index hit a 35 year high reading of 108.8, best reading since Reagan was in office. Like Reagans tax reform, we continue to expect the US economy to surge. Also like Reagans tax reform, which sent the Dow Jones 120% higher inside of 3 years, we expect the DJ to more than double in Trumps first term. Our target remains DJ 40,000 by end of 2020.

Even more signs of a US economy that is gathering steam. Middle class income hitting all time highs. #TrumpEconomicMiracle

As I mentioned earlier, Trump has announced he wants trade talks to resume with China. It’s been my belief that Trump wants a deal with China prior to the midterms. If you’ve read The Art of the Deal, Trumps actions to date appear right out of his 1987 mega-best seller. US markets rallied higher on the news.

VRA CHART ANALYSIS

As we get into these charts, remember that technical analysis makes up roughly 30% of the VRA Investing System. I find it incredibly helpful for timing purposes (entries and exits), but my go-to is fundamental analysis. I know lots of successful money managers that focus primarily on the fundamentals (macro and micro), but I know very few that focus primarily on technicals. Either way, this was the style of my mentors and it remains mine today.

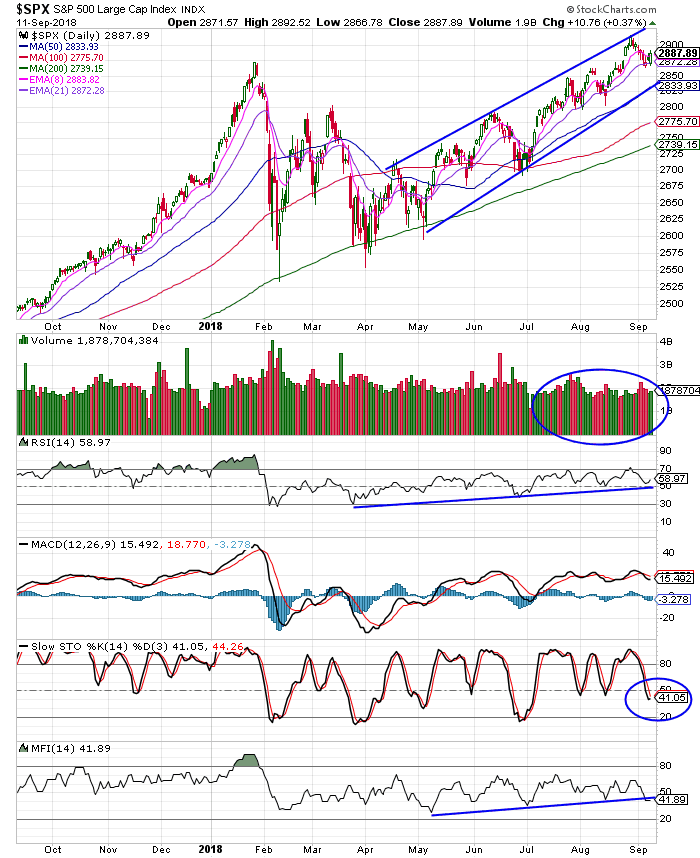

S&P 500

As the largest global equity index, we’ll start here. Beautiful, ascending wedge pattern. From our “extreme overbought” levels of last week, this pause looks to be playing out with perfection. Septembers aren’t my favorite month, but so far, so good.

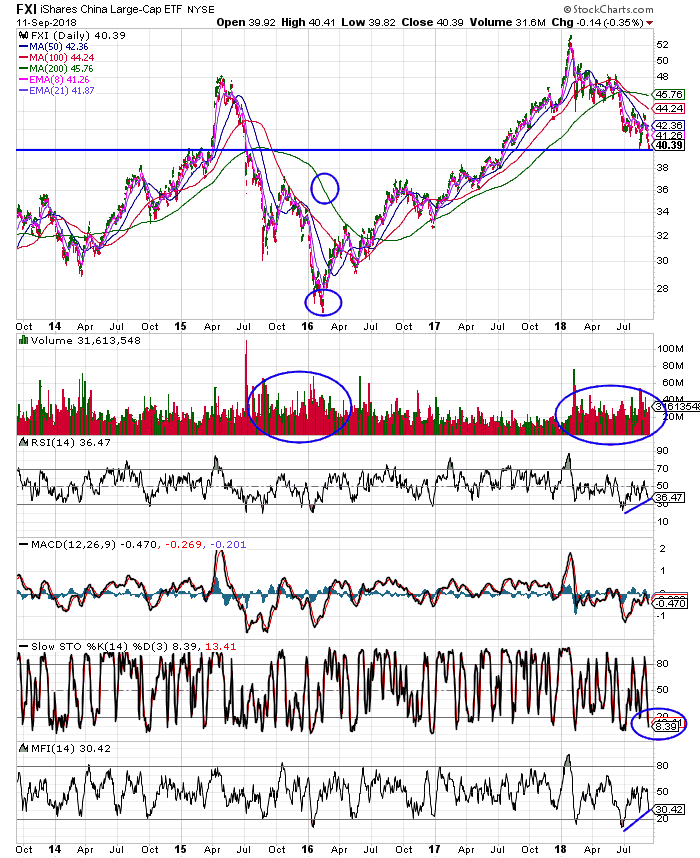

FXI (China ETF)

Below is a 5 year chart of FXI . As you can see, China is not immune to big swings, up and down. During the 2015–16 emerging market meltdown, FXI fell some 27% beneath its 200 dma, the largest gap since the ’08 crisis. Today, that gap to the 200 dma sits at 11%, second biggest in 10 years. I see some interesting parallels to previous sell-offs and should a trade deal get done, look for China to jump in fairly short order. Trump has cleaned China’s clock. I remain doubtful that China wants to repeat the mistakes of Japan, from the 80’s and 90’s. Lets hope not; Japan saw 75% losses in their stock market and a 19 year bear market in real estate. China, get a deal done!

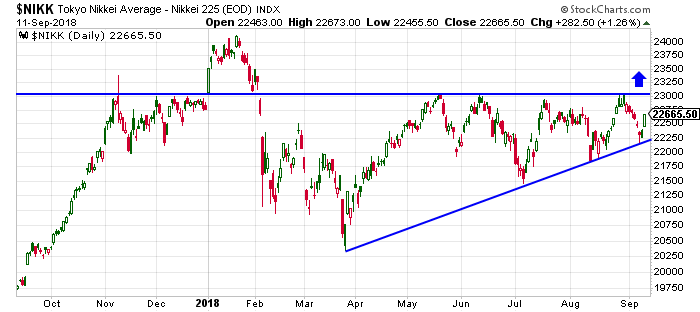

Speaking of Japan, while we have no holdings here, I found this chart interesting. It confirms for us that not all Asian markets have been weak. Japan’s Nikkei is up 12% from the March lows and less than 6% away from new all-time highs.

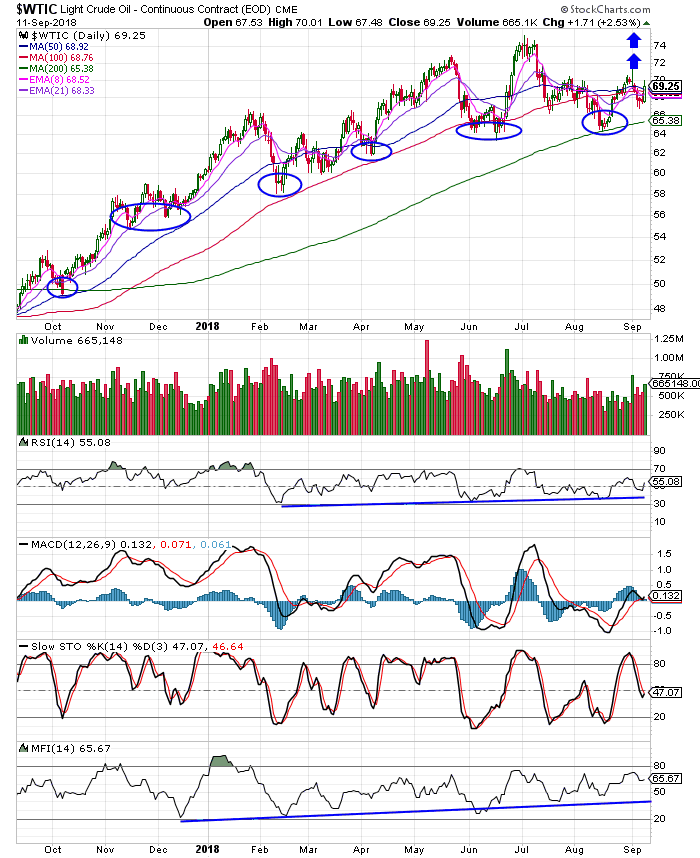

OIL

Below we see a clear cut pattern of higher highs and higher lows. Based purely on technicals, I see a measured move to $100/barrel +. Fundamentally, the supply/demand story for oil could hardly be more bullish. And watch what happens to the price of oil once a US/China trade deal is done. I was bearish on oil at $100 (2014) and became ultra bullish on oil at $32 (2017). I’m as bullish today…at $70.41…as I was at $32.

HGX (Housing Index)

HGX resides some 6% below its 200 dma, and if you’ve been here for any length of time, you know that I do not buy stocks below their 200 dma. Still, the fundamental side of housing remains incredibly bullish. Again, the fundamentals override the technicals in the VRA System. In this chart, I do see a rounded turn higher developing. A break above 307 on this chart will confirm the (sharp) move higher. In other words, I may be early…but I don’t believe I’ll be wrong.

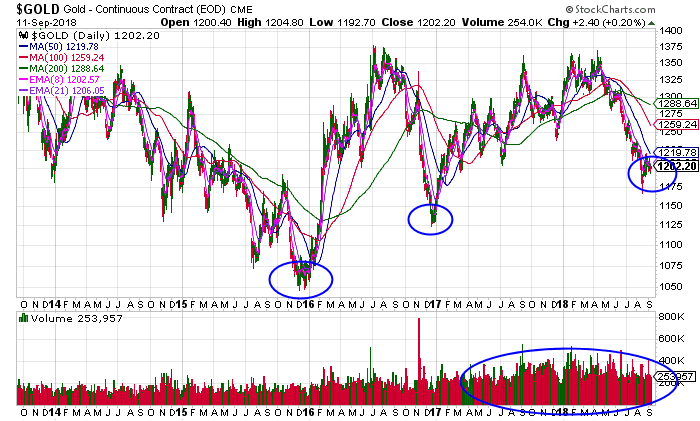

Precious Metals (Gold/Silver)

We own both gold and silver (I always recommend physical over ETF’s like GLD or SLV and I also prefer something like Gold/silver Eagles over numismatics). Below is a 5 year chart of gold. Yes, it remains in a well defined and bullish uptrend, from those late 2015 lows, but 2018 has been brutal to precious metals. The primary culprit has been a vey strong US dollar. But I believe the even stronger culprit has been a weakened China. From 2009 to 2014, China purchased more than 50% of the worlds commodities, from base metals to precious metals. Trade deal disputes have severely dampened China’s appetite. Again, I see a reversal in the near future.