VRA Update: A Strong US is a Strong Global Economy. US — China Trade Talks Back On. Lowest Youth Unemployment in 52 years!

/Good Friday morning all. Following a big (bullish) day higher yesterday…with solid market internals… here are my thoughts this morning.

Buy the dip is evolving into “aggressively buy the dip” for US stocks. This bodes well for our markets as we finish the year out. Again, with just 36% bulls on AAII Sentiment Survey, we never came close to “investor euphoria”. Investors falling in love with stocks is a near requirement before we have a final bull market top. That has been exactly my experience for 33 years.

Housing Technicals v. Fundamentals

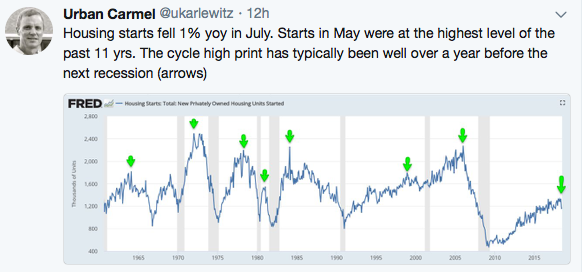

In our conversations around housing, I came across this yesterday. Housing starts have slowed, yes, but in May they hit their highest levels in 11 years. As you can see below, housing tends to top a full year before the next recession hits. Simply nowhere near this today.

The housing market/real estate slowdown is much more structural in nature, mostly due to SALT revisions inside of Trumps tax reform. Trump was right to insist on these, even as he knew that it would mean a short term hit to the housing market. High tax states have their own issues to worry about…and that does not mean they should be the rest of the counties financial burden to bear. So, while technically, housing looks horrible, fundamentally, I see very much to like about the US real estate market.

Global Markets

45 global stock markets are lower on the year. This, along with the action in housing stocks, commodities and VRA market internals, is why the VRA System has dropped to 8.5/12 screens bullish. Still bullish, yes, but this action cannot be ignored. But my dominant macro theme remains unchanged; a strong US equates to a strong global economy. And folks, this is when the tide needs to turn. Further aggressive downside action in global equity/currency markets is NOT what we want to see. I believe a turn higher is next.

This is also when I’d like to make a major macro point…one that applies to pretty much all commodities as well as global/emerging market economies/US markets. As you know, I didn’t buy into the fear based MSM that said the Turkish currency crisis would take the rest of the financial world down with it. And it was the action in gold that told us this (gold always spikes higher in times of global currency crisis…but gold has gone the other way).

Turkey is taking action to prop up its currency by banning short selling and news that Chinese regulators are freezing approvals of news game licenses coupled with a poor earnings report from Tencent Holdings (TCEHY) is causing breakdowns in some of the best performing China stocks during the past year. Trade issues also continue to weigh heavily on China….pushing the indices into bear market territory.

As we discussed in our VRA updates to members, emerging markets/China are approaching their most oversold levels (to US markets) in 2.5 years. Does not mean they cannot continue lower, but when markets reach extreme levels of oversold conditions, we know that the weak hands have likely sold their positions…this is how significant, major market bottoms take place. August is commonly that month in emerging markets.

Also, know that China has had their clock fully cleaned by Trump. Yesterday we learned that trade talks are soon to be back on. Global markets are rallying on the news. It’s my continued belief that August will prove to be the best buying opp of the rest of ‘18.

Lastly on this topic, the AP had an interesting read this week on the developments in emerging markets….those same economies that were allowed to steal US jobs, wage growth, and GDP over the last 3 decades. But there’s a new sheriff in town. Those days are over. Now, with US interest rate normalization, a strong dollar and a booming US economy, foreigners are piling into US investments (of all kinds). Hugely bullish for US markets.

And the US earnings bonanza rolls on. With 459 S&P 500 co’s reporting to date, 80% have beaten estimates on 26% earnings growth. For those that bought into the lefts argument that “supply side economics does not work”, you may want to take a second look at whats happening in just 1.5 years under Trump.

Here’s what does not work. Open borders, big business globalism. We allowed our masters of the universe to import cheap labor while exporting US jobs, manufacturing and GDP at the same time. A recipe for economic destruction. Slowly but surely, we’re seeing a global wake up call to the abject failures of globalism. The answer to economic prosperity lies in true competition…not in manipulated economic policy that picks winners and losers. True capitalism is the source of economic prosperity. History has proved this point, without question.

Again, the biggest issue facing the markets right now is seasonality. We are in one of the slowest and most negative times of the year…there isn’t much of an appetite, or investors around, to aggressively buy weakness.

Lowest Youth Unemployment Rate in 52 years!

Kids are headed back to school and Wall Street will soon head back into the office. As we’ve discussed, August is the most common month for emerging market currency panics, just like the one we have seen develop with Turkey this month. Not only do I see no signs that the US economy is slowing, instead, I see continued signs that our economic ship is being righted. We cover these facts here regularly, but here’s a new one…from late yesterday; the youth unemployment rate just hit a 52 year low. What a good sign for our future!

Until next time, thanks again for reading…have a great weekend.

Kip