VRA Update: Nailed it. Steroid-like Move Higher, Melt-up. VRA Market/Portfolio Review. 68% Average Gain on All VRA Buy Recommendations.

/Good Thursday morning all. Another big green day in US and global stock markets as bears capitulate, by covering their shorts, and then add to the already surging buyside volumes by then going long themselves. This is the nature of how a big move higher in the stock market occurs…this one looks to be just getting started.

VRA Market/Portfolio Update

Another big move higher in the markets yesterday. If you’ve been able to join us on our end of day podcasts (sign up at vrainsider.com/podcast), you heard the following: yesterdays new highs to lows hit 859–172. Stunning broadening action. It also marked back to back to back days of 5–1+ readings.

Last time we saw this? Early January…just prior to a 1300 point move higher in the Dow Jones.

But…VRA System readings are getting stretched. Take a look:

Nasdaq: 97% overbought. Extreme readings…however, MFI and RSI still have a ways to go (avg of 73%).

Russell 2000: 96% overbought. Extreme as well…however, MFI and RSI have a ways to go (avg of 72%).

S&P 500: 92%. Extreme as well…however, MFI and RSI at just 50% avg.

Dow Jones: 69% overbought. Room to run. MFI and RSI 46%. The DJ…the most trade-centric of indexes…is in fine shape, which helps to explain why it is now leading the way…playing catch-up.

Bottom line: while I fully expect the move higher to continue, this is almost always when investors get greedy…when they make mistakes. No need to sell…no need to be overly concerned…but absolutely the time to pick our spots more carefully.

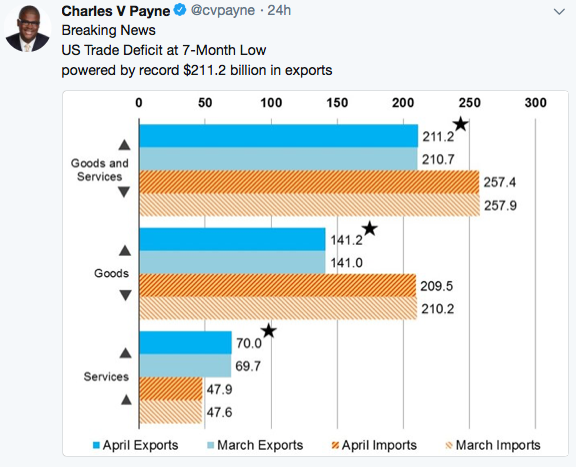

Note: Trump is KILLING it on trade. Wilbur Ross, Commerce Secretary and self made billionaire himself, is the freaking man.

We’re seeing some serious broadening patterns take place. There is no more bullish a market. But no…we’re nowhere as cheap as we had been.

This brings us to GDX (Miner ETF). And this chart.

From the initial breakout higher, which the VRA nailed pretty much to the day back in January 2016, GDX went on a tear, rising some 145% over the next 8 months. Then, it crapped out. Hit a big wall, which I completely missed. The result has been the 18 month sideways pattern you see below.

But its not all bad. This sideways action is one of the biggest coiled springs you’ll see. Should it break higher, which I fully expect, we’re looking at a measured move to something like $50 on GDX…or 120% higher than todays $22.50.

But first, we need a move back over the 200 dma. It’s close…just .25 away. Following that, and this will be the real kicker, we want to see GDX top $25/share. When this happens, look out above. And yes, these moves need to take place on volume as well.

Next up, take a look at this chart of oil (USO, Oil ETF). If you like channel trading (I do) and if your like probability investing (I do), oil looks like a screaming buy here. If you wanted to play this for a move higher you may want to use OILU (3 x Oil ETF). OILU has collapsed 25% in just 2 weeks. If my global reflation trade theme is accurate, and with the US dollar looking top heavy (oil is priced in USD), OILU could be an interesting short term play. We’ll take a closer look a bit later.

As a reminder, we use the VRA System to ensure we are on the right side of the market, and in the right sectors, primarily through the use of leveraged ETF’s. Leveraged ETF’s give us the greatest bang for our buck (up to 3 x times the move in broad market ETF’s) while removing the risks of owning a single large cap stock, where anything and everything can go wrong.

However, instead of putting on a new leveraged ETF position…like OILU (3 x Oil ETF)…we will be a bit more patient. We use leveraged ETF’s profit from broad market moves, while our small cap growth stocks give us our opportunity for 100%…300%…1000% moves higher. We’re watching a couple of additional small caps that could be added next. So, we’ll keep our 3 leveraged ETFs in the portfolio now without adding a new position here.

Our goal is to own 10–12 positions, max, giving us the ability to own larger position sizes than would be the case otherwise. This is how we crush Mr Market. Plus, once PM’s and the miners break out, we want to have room to add more back to the portfolio. This is my thinking.

Until next time, thanks again for reading..

Kip