VRA Update: Fed Rate Hike. J Powell Owns a Dubious Record. Fear and Panic. Blood in the Streets.

/Good Thursday morning all. As expected, J Powell’s Fed hiked rates to 2.5% yesterday. The DJ had hit an intraday high of +330 just moments earlier…then Powell started talking…. -500 DJ within 30 minutes, before closing -351.

Powell said two things that sent the markets lower (850 point swing in the DJ):

1) Going forward, he pegged US GDP at 2% to 2.5% (‘19). It sounded very much as if that is his preferred target…not the 3% to 4% to 5% that Trump is targeting.

Who needs more and better paying jobs? Who needs wage increases? Powell sounded very much like an ivory tower policy wonk that is out of touch with the reality of everyday Americans.

2) Powell made it clear that the Fed’s $50 billion/month runoff of Fed holdings will continue, apparently regardless of how the economy reacts.

J Powell now has the unique distinction of having the equity markets sell off every time he gives an FOMC speech. Stocks have a well established pattern of moving higher during FOMC Fed Chair speeches…but Powell has sent the markets lower, each time.

Having said this, Powell got a lot right too. The US economy IS strong. The Fed does need to continue to reduce its balance sheet, which reached $4.5 trillion under Obama. And Powell’s Fed did reduce expected rate hikes in 2019 to two, from three, while also mentioning that even those hikes would be data dependent.

What’s the Wall Street/social media whisper conspiracy theory (it’s actually much more than a whisper)? This tweet sums it up pretty well. The deep state Fed, hard at work. Fear of the unknown takes over.

VRA Market, System Update

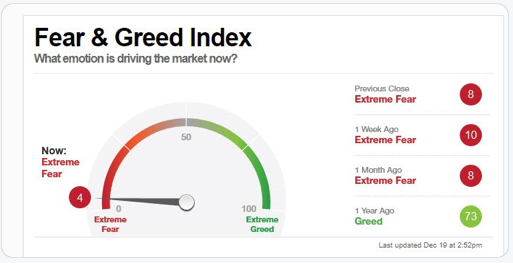

The VRA Investing System sits at 8/12 Screens bullish. We stand by our call yesterday that a sharp move higher is coming. Late last night we got the latest from the Fear and Greed Index…a reading of 4. This is the lowest reading in history. All time lows.

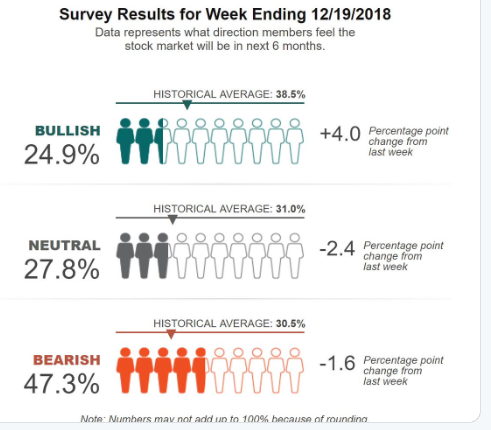

Combined with this weeks AAII Sentiment Survey readings (24.9% bulls and 47.3% bears), one thing we know for certain; investors are in full on panic mode. Blood in the streets, a fact that was confirmed last week by all time record weekly fund outflows of $46 billion.

As you’ve seen us discuss this week, at minimum we are due for a counter move higher. A significant one. Thats exactly how I see this year wrapping up. The VRA Market Internals from this move higher will determine what happens next.

Also, consider that the Russell 2000 is already down 25%. The S&P 500 is down 16%. Bear markets are defined by 20% moves lower….we’re there folks…assuming it stops at 20%. Again, I see us as being there, today.

And this; assuming we were to actually have a recession, according to Barrons banks stocks (on average) fall 31% (peak to trough) during a recession. As of yesterday, large cap banks/brokers are down 32%. Again, we’re there.

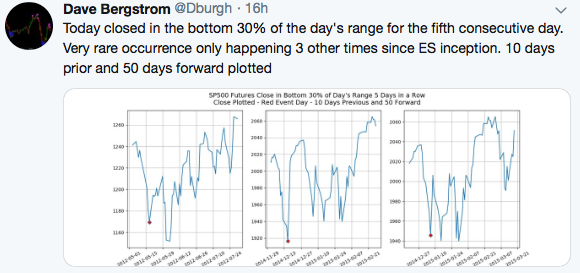

And this tweet from Dave Bergstrom (another good follow) is most interesting. SPX futures closed at the bottom 30% of their daily range for the 5th straight day. This has happened just 3 other times. As you can see, following each of these, the markets have roared higher. Another solid example of “extreme fear”.

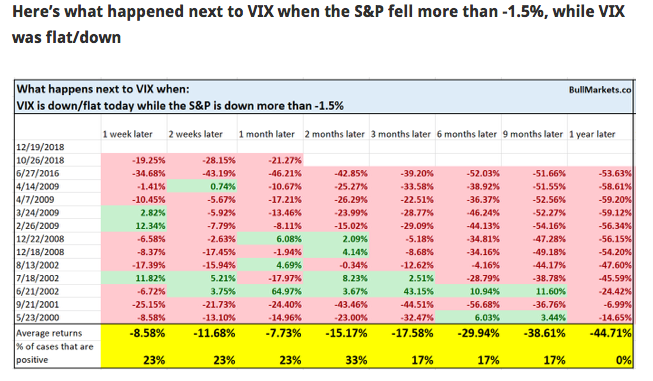

And this from Bullmarkets.co. Yesterday the VIX actually fell, while the S&P 500 dropped 1.5%. Historically, this is a harbinger of sharp falls for the VIX (which is a major market positive), with the “average” decline in the VIX over the next year of 44%.

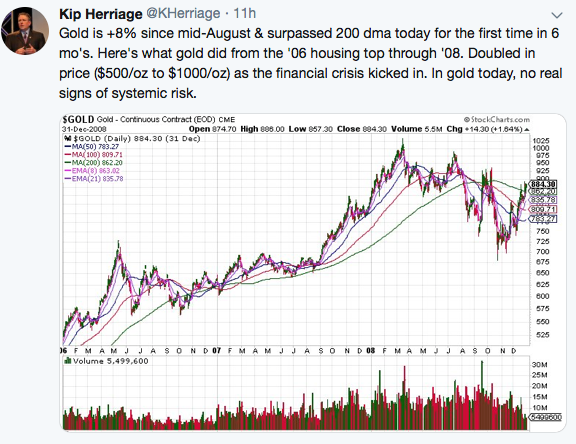

And my tweet from last night. Below is the chart of gold from 2006–2008, just as the housing crisis was kicking off and financial panic was nearing. Gold did its job as a predictor of systemic issues to come, rising from $500/oz to $1000/oz, a 100% move higher. But today, gold has risen just 8% since August. Does not mean that it won’t spike higher from here, just that as of today, gold is not predicting a systemic issue is on the horizon.

As a reminder from yesterdays update, all 4 broad market US indexes are now at “extreme oversold” levels. Again, time after time, we see panic occurring in sentiment and technicals. While at the same time, the US economy continues to expand, rather than decline.

And here’s a positive to keep in mind. To date, for ’18, a record $800 billion in share buybacks has already occurred. But from corporate commitments, we know that another $300 billion remains left to be bought back, which will take the record number of buybacks to $1.1 trillion this year.

I believe we are on the cusp of a 50% retracement from the current move lower. This would take the DJ back to roughly 25,000 (closed at 23.323 yesterday).

In our next update we’ll get into VRA growth stocks…they are primed for great things in ‘19.

Until next time, thanks again for reading…

Kip

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.

For our latest free updates tune in to our daily VRA Investing Podcast atVRAInsider.comor subscribe to our free blog at kipherriage.com