VRA Update: The Lows Are in Place. 3 Points of Importance. Mid Term Election Pattern Says we MUST Own Stocks Now.

/Good Friday morning all,

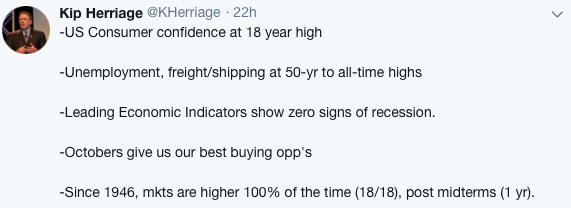

The markets lows are in place, for all of the reasons we’ve been covering here. The combination of incredibly strong US economic conditions, surging corporate earnings and seasonality investment factors tell us that we must be in this market.

3 points of importance:

1) We must get back above the 200 dma in each of our major indexes, the DOW is there now. Another good day of gains like we saw this week would take care of this for all indexes except the Russell 2000, which has a bit further to go.

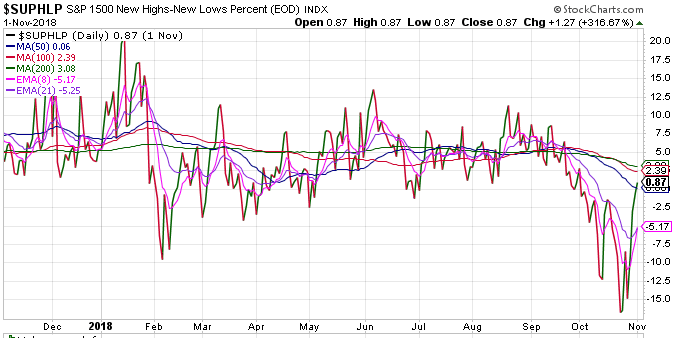

2) Market internals must continue to improve. Yesterday featured 3–1 positives in advance/decline and even better in numbers in up/down volume. Solid. But new highs to lows came in at 92 new highs to 285 new lows…this is the lone indicator that continues to trouble us most. Again, these readings are improving, but until we see marked improvement in this single indicator, we cannot discount a retest of the lows.

3) Get past the midterms. 2 trading days left after today. It’s my belief that the market enjoys a divided DC. We remember well how US markets soared under both Clinton and Obama…both presidents had divided governments.

Regardless, getting past 11/6 will remove the current volatility. You know my views…expect a strong move higher into year end/Q1 ‘19.

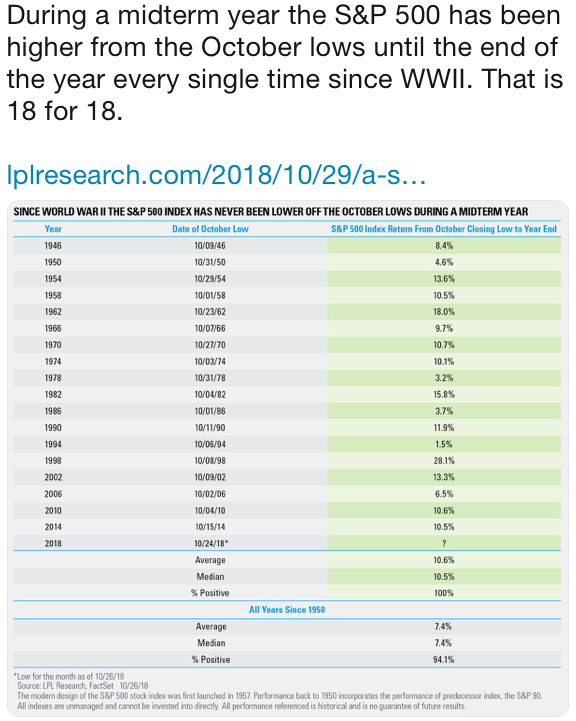

As we’ve covered, every midterm election year since 1946 has seen stocks soar over the next 12 months. Here, we also see that every midterm year since 1946 the S&P 500 has been higher from the October lows to the end of the year. 18 for 18 with an average gain of 10.6%. Repeating patterns like this are hard to find. Almost impossible to find. Repeating patterns tend to be an investors best friend.

Employment

Minutes ago we learned that US employers added 250,000 jobs in September, blowing away estimates, with wages rising 3.1%, best in a decade. Unemployment rate of 3.7%, best in something like 50 years.

I’m a broken record on this but lets review some basics, one more time:

Trump was elected, to a large degree, because he is a businessman (and because HRC was an awful candidate with an intern loving dirtbag for a husband). Tax reform + regulation destruction + new trade deals = animal spirits unleashed. It’s that simple.

Next up; US GDP is headed to 4% growth for the full year (2019), with the very real likelihood that US GDP will break 5% by the end of Trumps first term.

Trump has crushed China. They’ve already lost…they know it. Now they can go the way of Japan from the 80’s/90’s or choose to implode.

Our view has not changed. The Dow Jones will break 40,000 by the end of 2020. The DJ will break 30,000 in “early” Q1 ’19. Pullbacks must continue to be bought.

The theme for 2019, as global equity markets rock and roll:

1) Nationalism beats globalism. The events in Hungary, Poland, Brazil, plus of course Brexit and Trump mark the beginnings of a massively important worldwide pattern change. HIGHLY bullish for stock prices. Even more bullish for human beings.

2) Global reflation trade. Oil, most commodities and metals and emerging market economies will soar over the next 2–3 years. But the real action will be in stocks, as the public falls back in love.

While real damage was done in October, not to worry, strong US fundamentals should now take over. The forward P/E on the S&P 500 now sits at 14.6. Far too low, IMO, with what will be another year (’19) of 13–15% earnings gains. I predicted 15% for ’18 and today we’re at 26%. Dollars to donuts I’ll be on the low side in ’19 as well.

Until next time, thanks again for reading…

Kip

For our latest updates tune in to our daily VRA Investing Podcast atVRAInsider.com

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.