VRA Investment Update: The Buy Signals Are Back. The Trump Economic Miracle, Still Driving the US Economy.

/Good Thursday morning all. Back to back excellent days, with strong smart money hours and market internals to match. In addition, tech/semis are leading the way, with seasonally bullish small caps charging higher. If you’re a market timer, these are the short term, heavily bullish signals you look for.

Authoritarian tyrants the world over might be doing their damnedest to keep CV insanity alive, but We The People have the final word. Once we stop complying, this madness ends. Slowly buy surely… even in blue states…the masses are moving on from the plandemic.

Using the VRA Investing System as our timing guide, we took profits on several positions in November, as our markets hit extreme overbought (on steroids) on the VRASystem. Beginning earlier this month we began re-building the VRA Portfolio (VRAinsider.com). Each remains a buy here, as we expect 2022 to be a strong year for our markets as well. The markets don’t peak until earnings peak…and we don’t see corporate earnings peaking until 2025–2026.

This remains the bull market of bull markets, driven by The Big Bribe, $37 trillion in fresh global stimulus and surging corporate earnings. Dow Jones 100,000 remains our long term target…and its exactly the current action in investor sentiment that helps to cement our view. The Fear & Greed Index collapsed from 87 (Extreme greed) to 18 (Extreme fear) inside of 3 weeks. Seeing the same type of collapse in sentiment survey after sentiment survey. This is NOT how bull markets react at significant tops. What would concern me? When the markets fall 5% but sentiment remains overwhelmingly bullish, that’s the type of red flag we’d pay attention to.

However, when the markets fall just 3–5% and investor sentiment plunges to extreme fear, contrarians know what this most likely represents; a major buy signal.

The bigger point here, from the medium-long term view, is that the US economy is still being powered by “The Trump Economic Miracle”. As much as our current fearmonger-in-chief tries to take America down, by killing Trumps economic magic wand, Biden keeps failing miserably while Trumps low taxes, less bureaucratic red tape and his America First policies remain fully intact. The Trump Economic Miracle will continue to power the US economy for years to come.

And have you noticed what’s happening in China? Many of Trumps China tariffs remain in place, while Trump also exposed China for what they are; brutal communists that rule only by government force and propaganda (AKA what the permanent ruling class has been desperately trying to force on America). KWEB, the China Internet ETF and a significant discounting mechanism/barometer for the Chinese economy, is now down 63% from its 2021 highs. FXI, the largest US traded China ETF is down 34%. Again, Trumps America First polices continue to do their thing. China is “uninvestable”, much like Japan was beginning in the early 1990’s.

With Biden as a lame duck, a first in modern history for a president inside of his first year, America is in much better political shape than many believe. Soon, the markets will begin to discount the midterms, which we expect to be an avalanche of destruction for Dems. That will give the markets what they love just about more than anything; gridlock in DC.

We remain highly bullish on US stocks, for all time frames; short, medium and long term, with 10/12 VRA System Screens bullish.

As todays Stock Trader Almanac breaks down (next), now is the time to prepare for the Santa Claus rally, which technically begins on Monday, as its the last 5 trading days of the year plus the first 2 trading days of the New Year. Bullish Trading Ahead of Christmas: Small-Caps Lead

Everyone is anticipating the Santa Claus Rally, but that doesn’t start until next Monday, 12/27. The Santa Claus Rally was defined by Yale Hirsch in 1972 in the Stock Trader’s Almanacas the last five trading days of the year and the first two trading days of the New Year. This short, sweet rally is usually good for about 1.3% on the S&P 500, but the real significance of the SCR is as an indicator.

It is our first seasonal indicator of the year ahead. Years when there was no Santa Claus Rally tended to precede bear markets or times when stocks hit significantly lower prices later in the year. As Yale’s famous line states (2021 Almanacpage 116 and 2022 Almanac page 118): “If Santa Claus Should Fail To Call, Bears May Come to Broad and Wall.”

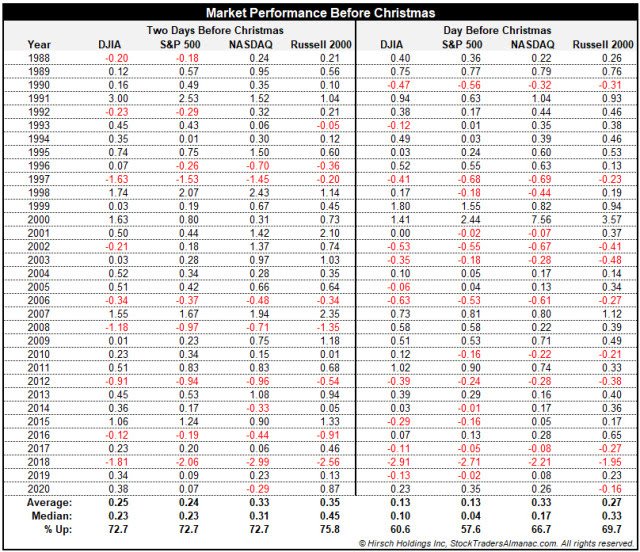

For decades we have been tracking the market’s performance around holidays in the annual Stock Trader’s Almanac. In the 55thedition for 2022, data for DJIA, S&P 500, NASDAQ and Russell 2000 can be found on page 100. Of the eight holidays tracked, Christmas has been one of the most consistently bullish with respectable average gains occurring two days before and the day before.

Tomorrow, Wednesday 12/22, two days before Christmas, has been more bullish over the past 33 years with greater average gains and a greater number of advances. Small caps measured by Russell 2000 have enjoyed the most consistent strength on both days. Volatility also tends to be subdued ahead of Christmas as well. Prior to 2018’s pre-holiday selloff, the worst decline recorded by any of the four indexes on either day was 1.63% by DJIA in 1997.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast