VRA Investment Update: FOMC Minutes, Dovish. Extreme Overbought, Patience. Housing, Still Powering the US Economy.

/Good Thursday afternoon all. The Fed minutes from the July meeting are out and, surprise surprise, they show a Fed with multiple members expressing concerns about tightening rates too much. Good. That means they are actually following the data, which is exactly what they are supposed to do. The countdown is already on for early next year when the Fed starts cutting rates again, as inflation is turning into disinflation and next year will turn into full-on deflation. This of course is a bullish set up for stocks.

Gold rallied a bit on the dovish Fed news, but the miners (GDX) still closed down 3% on the day. Not that I can make sense of this, because it makes no sense. We are in the most bullish time frame of the year (first week of August til mid-October), with sentiment flashing big buy signals and commercial players bullish. The chart of GDX still shows an early pattern of higher highs and lows over the last month and GDX remains in a rising channel. Still high probability that this group rallies hard over the next 2.5 months and into year end. Goldman Sachs target of $2500/oz gold remains in place. We are buyers of VRA 10 Baggers and physical gold and silver.

Extreme Overbought, Patience

The markets are working off their extreme overbought readings, a process that takes time and patience. This market has been so strong that I expect any pause should be short-lived. S&P 500 futures positioning shows the largest short position since June 2020, meaning a short covering rally could continue to be a driving force for higher prices (along with underinvested fund managers).

We avoid adding to our broad market positions when we hit extreme overbought on the VRA Investing System. Again, patience and discipline the key here. But with the “melt-up into the midterms”, as Tyler covered well in his podcast yesterday, we’ll also be surprised if this overbought pause turns into a steep sell-off.

VRA Leading Economic Indicator “Housing” Still Strong, Powering the US Economy

Housing, the most important leading economic indicator for the VRA Investing System, continues to power the US economy. Over the last 2–3 weeks I have reached out and spoken with 7 VRA Members that are leading business owners and entrepreneurs in the housing, real estate and mortgage markets across America, covering the most important economic segments of the country. Each repeated a a very similar story to me; yes, things have cooled off but the housing and real estate markets are still very vibrant, even strong. Cash buyers are still everywhere, with homes selling in near record time. I was struck by their positivity and bright outlooks. Alphas all. I love speaking with entrepreneurs.

As always, we should guard against the permabears of the myriad sites like Zero Hedge and the plethora of doom and gloom purveyors that see economic depression and housing crashes around every corner. There is a psychological operation in place in this country…the Cloward-Piven design…to demoralize and depress us. Designed to make us weak and vulnerable. We must reject this communist tactic used to take down republics/democracies. America is undefeated…and communism always loses in the end.

But yes, as quickly as mortgage rates have risen, the red-hot housing market has cooled off. The Fed’s rate hikes and hike-a-mania rate hike jaw boning has worked, along with 40 year highs in inflation, to cool off the 20% per year home price appreciation. Ed Hyman, true guru economist at Evercore notes that we now have recessionary readings in housing in the US. That means growth has gone beyond slowing…it has stalled almost completely. This was by design by the Fed. So far, so good.

All of this has people asking: Is today’s housing market in the same predicament that it was over a decade ago, when the 2007–08 crash caused the Great Recession?

The short answer is: no.

1) For the 53.5 million first lien home mortgages in America today, the average borrower FICO credit score is a record high 751. It was 699 in 2010, two years after the financial sector’s meltdown. Lenders have been much more strict about lending, much of that reflected in credit quality.

2) Home prices have soared, as well, due to pandemic-fueled demand over the past two years. That gives today’s homeowners record amounts of home equity. So-called tappable equity, which is the amount of cash a borrower can take out of their home while still leaving 20% equity on paper, hit a record high of $11 trillion collectively this year, according to Black Knight, a mortgage technology and data provider. That’s a 34% increase from a year ago.

3) At the same time, leverage, which is how much debt the homeowner has against the home’s value, has fallen dramatically.

Total mortgage debt in the United States is now less than 43% of current home values, the lowest on record. Negative equity, which is when a borrower owes more on the loan than the home is worth, is virtually nonexistent. Compare that to the more than 1 in 4 borrowers who were under water in 2011. Just 2.5% of borrowers have less than 10% equity in their homes. All of this provides a huge cushion should home prices actually fall.

4) There are currently 2.5 million adjustable-rate mortgages, or ARMs, outstanding today, or about 8% of active mortgages. That is the lowest volume on record. In 2007, just before the housing market crash, there were 13.1 million ARMs, representing 36% of all mortgages.

5) Mortgage delinquencies are now at a record low, with just under 3% of mortgages past due. Even with the sharp jump in delinquencies during the first year of the pandemic, there are fewer past-due mortgages than there were before the pandemic.

“The mortgage market is on very historically strong footing,” said Andy Walden, vice president of enterprise research at Black Knight.

“Mortgage credit availability is well below where it was just before the pandemic”, according to the Mortgage Bankers Association, suggesting still-tight standards.

The biggest problem in the housing market now is home affordability, which is at a record low in at least 44 major markets, according to Black Knight. While inventory is starting to rise, it is still about half of pre-pandemic levels.

“Rising inventory will eventually cool home price growth, but the double-digit pace has shown remarkable sticking power so far,” said Danielle Hale, chief economist at Realtor.com. “As higher housing costs begin to max out some buyers’ budgets, those who remain in the market can look forward to relatively less competitive conditions later in the year.”

VRA Bottom Line: until and unless the US housing market cracks, the US economy will remain on firm footing. Combined with our second most important leading economic indicator (transportation), which continues very near all time revenue levels in the US, the foundational strength of the US economy remains intact. If we have a “real” recession (NBER) it is unlikely until mid-late 2023 (at the earliest). As a reminder, by the time economists pronounce that an official recession has begun we are already out of it, with stock prices on average 15–20% higher.

Combined, here’s what this bear market most likely represents; a stock market, economic and housing reset. We have been aggressive buyers of the market, and specifically VRA Portfolio holdings, since late May. Never bet against America.

9/11 Gave Birth to The Patriot Act Which Gave Birth to the Deep State. Must Read.

If you want to know how we got here, here’s the piece that makes everything clear. The Patriot Act was written long before 9/11 and then enacted just 5 weeks after the attacks.

The Patriot Act produced the deep state and very importantly, our 4th branch of government, the Intelligence Branch. This is the branch that is our shadow government. The actual deep state. This is the branch that rigs elections and starts wars. This is the branch that decides who gets elected and how they vote. The branch that tells the Justice Dept and FBI what to do. This is the imbedded evil that Trump and patriots all across America are fighting. Everyone is talking about this piece (thanks to VRA Member David S for sending my way). Read/share.

This is What Happens When Elections Cannot Be Rigged

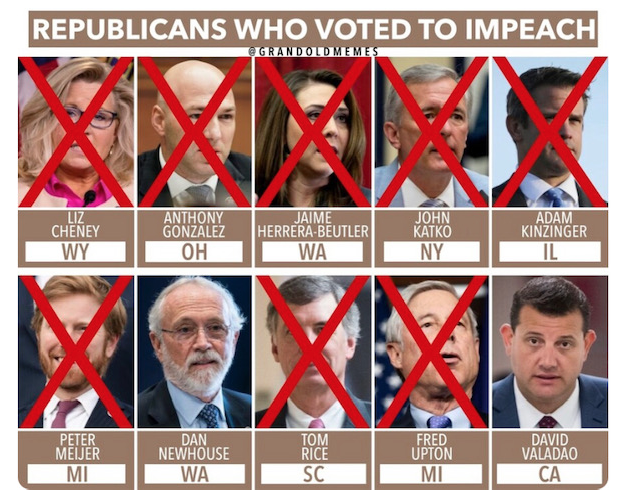

Liz Cheney got absolutely smoked last night by Trump-endorsed Harriet Hageman, losing by 37 points, the fourth loss loss by an incumbent since 1968.

Trump has now taken down 3 dynasties; Bush’s, Clintons and Cheneys. Trump is the closest thing to George Washington this country has had, since Washington himself (now Mr. President, please focus on staffing and avoiding deep state events, like plandemics). Cheney will of course head right to CNN/MSNBC where she will be celebrated by Deep State, Uniparty America-haters.

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Truth Social and Rumble