VRA Weekly Update: Goldman Sachs is Getting the Idea; This is a Melt-up Bull Market. Our Eyes Are On China.

/Good Thursday morning all. Another poor jobs report (ADP) took the Dow down 323 points yesterday. Like the Obama economy, we should get used to reports like this. Soon, and take this to the bank, they’ll be manipulated to start looking better, with part time and low paying jobs making up the bulk of the jobs gains. But remember, little of this will matter to our melt-up markets, which will only continue to head higher. Unprecedented global liquidity and surging corporate earnings will remain the primary drivers, as financial engineering produces our most powerful bull market since the 1995–2000 melt-up (575% gains in Nasdaq).

This morning Bloomberg reported that Goldman Sachs just became the most bullish firm on Wall Street, as they’ve raised their year end target on S&P 500 to 4700 (SPX Closed at 4402 yesterday). It’s good to see the vampire squid following the VRA’s research and overwhelming bullishness. But Bloomberg is wrong (again) as Evercore (our favorite economists and market watchers) have long had their year end target at 5000.

You know our views on investor sentiment. If we had to pick a single reason to be hyper-bullish, bearish investor sentiment at all time highs would be that reason.This morning the Fear & Greed Index sits at 26 (Fear).

Once these readings are hitting 80–90% (Extreme Greed), we’ll start getting concerned about an 8–10% correction.

We continue to have one primary short term concern about our markets; the internals continue to be weak, with NYSE volume negative by 3:1 and advance/decline by 2:1, although Nasdaq was much better and 52 week high/lows came in at a solid 298–157.

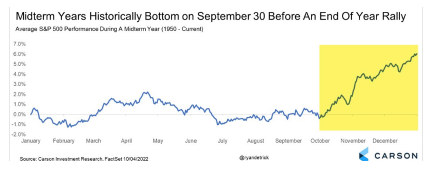

We’ve now had 6 months of positive market action in the S&P 500, following a down January, marking the first time in history the S&P 500 has been positive for the next 6 months after a down January. Well, this is that bull market.

And check this out; it turns out that 6 month winning streaks are overwhelmingly bullish. Since 1946 it’s only happened 21 times and a full one year later the markets were higher 18 times (85% win streak) with an average gain of 11.9%. We’ll take all of that. In addition, the semis led the way higher, once again, with SMH (Semi ETF) hitting all time highs.

As we see in the chart of SMH below, this breakout to fresh ATH looks ready to power sharply higher. Where are now near overbought on VRA Momentum Oscillators with a fresh MACD buy signal from last Thursday and obviously above every moving average that matters most.

Here’s why this matters to us. The semis lead Nasdaq and Nasdaq leads the broad markets. With Q2 earnings demolishing estimates, if the semis continue to lead higher, look out above.

A couple of points on the “Delta variant”, which J Powell smartly reminded us all last week is having little impact on the economy, because that’s how mutating viruses work…each strain is weaker than the one before.

Goldman Sachs reported over the weekend that the Delta wave has peaked in the UK, Spain and Netherlands and will peak elsewhere in the next 2 weeks (aka the US).

And at the end of the day, here’s the only graph that really matters; the mortality rate in the US has plummeted back to its lowest levels since March 2020.

As the markets have known from the CV insanity lows of 3/23/20, coronavirus is in our rear view mirror.

Final note. If you heard our podcasts this week you know that we’re closely watching the goings-on in China. Something interesting is up in the land of increasingly hard core communists. Pending military action re Taiwan or Hong Kong? Karma over CV insanity, which could/should include 10’s of trillions in global restitution?

We smell a trading opportunity approaching…just not sure when, exactly. As much as we have little interest in taking a long term stake in China (we like to sleep at night), both KWEB (China Internet ETF) and FXI (China large Cap ETF) have our attention. KWEB really has our attention. Down 55% from the Feb highs, Chinese internet stocks (KWEB) are trading like they have the plague. For those wondering about a China leveraged ETF, yes, they have a 3 x ETF (YINN). Our analysis is that KWEB would be the (much) better play (liquidity, safety).

VRA Bottom Line: should we have a capitulation event, brought on by bad news that we can quantify, be ready to act. We would look to buy KWEB or and KWEB calls (ST trades only).

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter