VRA Weekly Update: Big Disconnects Abound. AAII Bears Surge. Jeremy Grantham Interview. History Tells Us Now is the Time to Own Precious Metals

/Good Thursday morning all.

The 400 point swing in the Dow yesterday, from +220 to -170 at the close continues a bit this morning with Dow futures -140. One week ago today was the -1800 point move lower in the Dow (-6%) with -8% in the R2K…followed by J Powell to the rescue with the Fed’s unlimited corp bond buying news.

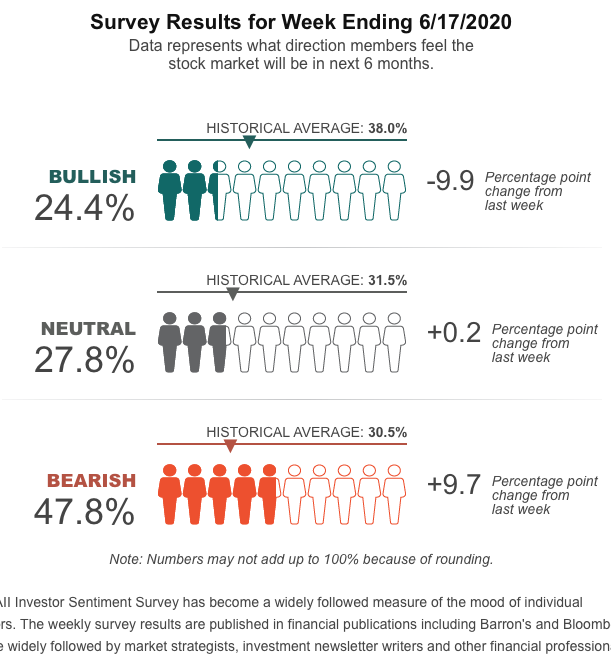

The disconnects between the V shaped move higher (post 3/23 lows) and a ravaged economy with 40 million newly un/under employed Americans has voters in the AAII Sentiment Survey on the edge this week as well. Bulls dropped a big 9% to just 24.4% bullish with bears rising 9% to 47.8% bearish.

I’ve voted in this survey for approx 30 years and if I only had this data to invest on (bulls at 24% after a 45% move higher in less than 3 months) I would be forced to be bullish. Interested to see if this week was a fluke. That 1800 point sell-off brought back lots of memories of late February.

And here’s the biggest disconnect of all; the disconnect between earnings and share prices. Q1 earnings fell 16%, the biggest quarterly collapse since 2008 with Q2 earnings expected to be hideous as well. Yet, at the same time, the S&P 500 has recovered much of its 35% CV collapse. When the Fed’s all in, maybe price discovery and earnings no longer matter. Warren Buffets stock market may just be dead. Maybe this time is different (doubtful).

Just when I think that I’ve lost all interest in watching CNBC, they air an interview that matters. Investing legend Jeremy Grantham’s CNBC interview yesterday is must watch. Here’s the quote that got most of our attention; “You should have zero exposure to US equity markets. Ideally, less than zero”, meaning that investors should be completely out of US markets and short to boot.

It’s hard to argue with anything that Grantham says…and as he states, bubbles can go on much, much longer than most anyone could believe.

https://player.cnbc.com/p/gZWlPC/cnbc_global?playertype=synd&byGuid=7000141377

Here’s the accompanying article from MarketWatch

By Mark DeCambre, MarketWatch

‘And the chutzpah involved in having a bubble at a time of massive economic and financial uncertainty is substantial,’ says Jeremy Grantham

That is Jeremy Grantham, co-founder and chief investment strategist at Boston-based money manager Grantham, Mayo, Van Otterloo & Co., offering up a stark warning to speculators driving the stock market to new heights amid the greatest pandemic of the past century.

“This is really the real McCoy, this is crazy stuff,” said Grantham during a Wednesday afternoon interview on CNBC that appeared to knock some of the stuffing out of a market that had been drifting along listlessly on Wednesday.

Gratham painted a very dire picture of the investment landscape in the U.S., suggesting that rampant trading by out-of-work investors and speculative fervor around bankrupt companies, including car-rental (http://www.marketwatch.com/story/hertz-pulls-potentially-worthless-share-offering-2020-06-17)company Hertz Global Holdings Inc. (HTZ), reflects a market that may be the most bubblicious he’s seen in his storied career.

Read: The rise of mom-and-pop investors in the stock market will ‘end in tears,’ warns billionaire Cooperman (http://www.marketwatch.com/story/the-rise-of-a-mom-and-pop-investors-in-the-stock-market-will-end-in-tears-warns-billionaire-cooperman-2020-06-15)

“It is a rally without precedence,” he told CNBC, noting that the run-up comes amid a period in which U.S. economic health is at a low point, with millions of people out of work (http://www.marketwatch.com/story/jobless-claims-rise-154-million-in-early-june-but-fewer-people-are-collecting-benefits-2020-06-11) and bankruptcies likely to continue to rise due to a slowdown in business activity and closures that have come in the aftermath of lockdowns implemented to curb the spread of the deadly COVID-19 pathogen.

Markets, however, have been busting higher since hitting a low on March 23. Indeed, the Dow Jones Industrial Averagehas zoomed 40.5% higher since late March, the S&P 500 has climbed 39% and the technology-heavy Nasdaq Composite Index has soared more than 44% over the period, establishing an all-time high last week for the first time since Feb. 19

Grantham is worth paying attention to due to his prescient calls over the years. He said that stocks were overvalued in 2000 and again in 2007, anticipating those market downturns, the Wall Street Journal reports (https://www.wsj.com/articles/jeremy-grantham-predicted-two-previous-bubbles-and-now-1509937980). Grantham also signaled that elements of the financial market had become unmoored from reality leading up to the 2008–09 financial crisis.

Asked what level of exposure investors should have to U.S. equities, Grantham offered an unflinching view that may leave some bulls gobsmacked.

“I think a good number now is zero and less than zero might not be a bad idea if you can stand that.”

The investment expert noted that monetary stimulus from the Federal Reserve, whose balance sheet has jumped from $4 trillion in March to $7.21 trillion last week, and efforts by the government to help average Americans has been a factor that has helped boost equity values amid this crisis.

“Clearly, the Fed scattering money around has created a favorable environment.”

Even before the CNBC interview that aired on Wednesday, Grantham and those at his firm had been bearish (http://www.marketwatch.com/story/you-should-be-nervouslegendary-money-manager-slashes-stock-market-exposure-from-55-to-25-2020-06-05). “Uncertainty has seldom been higher…oddly, neither has the stock market,” warned Ben Inker, GMO’s head of asset allocation, adding that investment company slashed its stock exposure in its flagship Benchmark-Free Allocation Strategy from 55% in March to just 25% by the end of April.

— —

Precious metals industry superstar Egon von Greyerz is out with a stunner of a piece on what he sees as the collapse of the US and global economy and a record setting move higher in gold and silver. Highly recommended.

“The US is now leading the world economy into a total breakdown of not just the financial system but also of trade and social structures. And still nobody can see it. Stock markets are near the all-time highs and the high-end residential property market is booming in and around several capital cities.

The US has all the ingredients that lead to the destruction of an empire: Deficits, debts, excessive military spending, debasement of the currency, breakdown of trade, plague, the collapse of law and order and riots. Two things are missing to complete the picture namely wars, and hyperinflation. Sadly both these factors are likely to occur in the coming years.”

History Tells Us To Own Gold When Central Banks Run Out Of Control

June 17, 2020 Egon von Greyerz

https://www.gold-eagle.com/article/history-tells-us-own-gold-when-central-banks-run-out-control

THE LATEST PANIC STARTED IN AUGUST 2019

The current crisis started its acute phase back in August 2019. That’s when the Fed and the ECB started to panic.

Since then they have flooded markets with trillions of dollars and euros and still, the problems are not going away. But how can you solve a debt problem with more debt? I considered the Central Banks panic statements and actions back in August as an extremely critical moment and as important as Nixon closing the gold window in Aug 1971. I wrote back then that the “world is now standing before a seminal moment and virtually nobody can see it.”

THE END GAME IS STARTING

The US and the world are now entering the end of the end of 50 years’ destruction of the world economy and the financial system. So it has taken half a century to reach the end game but this is like a blink of an eyelid in the history of the world.

The US is now leading the world economy into a total breakdown of not just the financial system but also of trade and social structures. And still nobody can see it. Stock markets are near the all-time highs and the high-end residential property market is booming in and around several capital cities.

The US has all the ingredients that lead to the destruction of an empire: Deficits, debts, excessive military spending, debasement of the currency, breakdown of trade, plague, the collapse of law and order and riots. Two things are missing to complete the picture namely wars, and hyperinflation. Sadly both these factors are likely to occur in the coming years.

1971 marked the beginning of the end of the US Empire

Since 1971 the dollar has collapsed, deficits and debts exploded and social structures including law and order are breaking down. Like all empires, the US had the seeds of its own destruction within it.

This is how they achieved it:

https://www.gold-eagle.com/article/history-tells-us-own-gold-when-central-banks-run-out-control

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/17 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast