VRA Investment Update: Jobs Beat, Markets Like It. Inversions Predicting Fed Pivot. US Consumer Strong. Housing Boom Still Ahead. The Clinton Pivot?

/Good Friday morning all. Following yesterdays hot ADP jobs report we just learned that 223,000 jobs were created in the month of December, beating estimates in the 203,000 range, with the official unemployment rate falling to 3.5% from last months 3.7% (as more people enter the labor force and the Labor Force Participation Rate falls).

Tyler nailed this topic in his podcast yesterday, as he did with the reaction from the market (Dow is +530 as I write), in part based on the rather stunning market internals we’ve been seeing, even on down days. VRA Investing System buy signals.

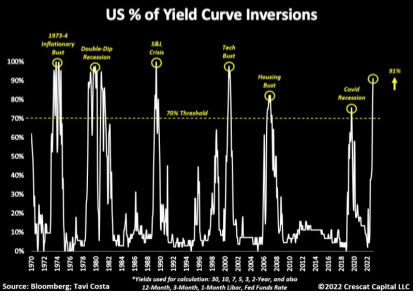

Stunning look at yield curve inversions.

The Fed MUST be watching this. Close to a record. Historically a strong predicator of recessions. We stand by our forecast; Fed rate cuts by Q4/early 2024.

Just Know This: the US Consumer is on Rock Solid Footing (as is Corp America).

This is a major theme of The Big Bribe and the Dow Jones hitting 100,000 by 2030. Nothing is more important than the housing market, our leading economic indicator .

Both mortgage debt service and overall debt service are in the top 90% historically (below). With unemployment this low and homeowners in great shape with 56% equity (all time record), any housing mkt weakness will be short lived. The downside of course is the fed may just keep hiking rates. They did it 17 straight times from 2004-2006, which caused the meltdown. They love breaking sh*t. Again, we see a Fed pivot nearing.

We are in the early stages of a long term bull market in housing. A housing boom.

Heads Up From The Big Bribe: Are We Watching the Beginning of the Bill Clinton Pivot?

We forecast this in our new book The Big Bribe (available on Amazon). After a wipeout in his first midterm election, Bill Clinton pivoted to the center, ran a budget surplus, the economy ran hot with approx 4% GDP and the Dot-com melt up had the market soaring. Clinton, over his 8 yrs, put up the best producing stock market gains on record for any president (26%\yr, S&P 500).

Are we watching the Biden pivot? Mitch McConnell attended an event with him this week (Uniparty protects their own), he’s going to the border next week & he’s trying to talk like a centrist. if so, what an interesting set-up as we head into 2024 elections.

This year is the 3rd year in Presidential Cycle (historically a hugely bullish year for stocks). If Dems can keep that momentum going, avoid a recession, and head into 2024 with the wind at their back…knowing that State-run media propaganda will always have their back…D’s could be hard to beat next year. If R’s aren’t gaming this out, they are fools. The markets would love this set-up BTW.

Trump Media (DWAC)

VRA 10-bagger DWAC, in the short term, is all about the approval of the merger, which should actually get a boost because of Trumps support of McCarthy. In fact, if Trump has not built this into his backing of McCarthy, I will be shocked. I’m hearing that the house will then pressure the SEC to allow the merger to be completed (this quarter). If that’s true we’ll start seeing it in the share price. If DWAC begins to get hot, immediately after McCarthy gets the job (IF), we will want to buy more DWAC.

There is more than a billion $ in funding waiting once the merger is done. Then we should hear from CEO Devin Nunes about their growth plans beyond Truth Social. Broadcasting (please, so we can dump Fox, just take Tucker with you), advertising, cloud services and very hopefully, replacement services for Paypal, stripe and GoFundMe.

Trump Media has a fan base like no other company on the planet…certainly with Musk losing some of his at Tesla. Truth Social is now the only publicly traded (true) free speech platform on the planet. Massive leverage from this. I’m still banned from Twitter, as are millions of patriots and truth tellers, and its clear that Musk has yet to really clean up twitter. I hear shadow banning is as bad as ever.

The upside potential for DWAC is extraordinary. If I were Trump and Nunes I would be working 24/7, knowing whats in front of me post-merger. If McCarthy gets the gig, watch DWAC share price closely.

A New Uniparty America; R’s Calling True Patriots "Terrorists and Insurrectionists"

Why January (and 2023) Should Sizzle (overwhelmingly bearish investors are a contrarians delight)

2023 is the 3rd year in the presidential cycle, which going back to 1950 has been the single best year to be an investor, with an average gain of 20.1%.

In addition, the first quarter of the year (the 3rd year in the presidential cycle) averages a gain of 6.9% in the S&P 500 and is positive 90% of the time (since 1950).

Our views are unchanged from the 10/13 capitulation lows; the dollar, interest rates and inflation have all peaked and US stock markets have bottomed. We will continue to use pullbacks to add to positions.

And the historical data is as powerful as I’ve seen in my career. In addition to the data above (3rd year in presidential cycle is extraordinarily bullish), consider these analytics as well:

One: History tells us that the worst years for stocks are followed by some of the very best years on record. As seen below, since 1950, following a 20% decline in the S&P 500 the market has been higher 100% of the time with an average gain of 27.1%. Again, the S&P 500 finished down 19.4% with Nasdaq down a stunning 33.1%.

Two: Importantly, and this remains the most powerful piece of analytics of my 37 year career; since 1952, from the midterm lows to 12 months later, the S&P 500 has had an average return of 32% with gains in every single post-midterm year (18 for 18). Bullish for 2023.

Until next time, thanks again for reading. Have a good weekend.

Kip

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

And check Out Our Latest (now daily podcast!) Videos on Rumble