December Was a Stock Market Aberration. VRA System Market Internals Flashing Buy Signals. Housing is Solid, Housing Stocks are Cheap.

/Good Thursday morning all. Our broad market recovery move higher continued yesterday as FOMC minutes were released that showed Chairman J Powell and Fed Governors explicitly “meant to say” that their December rate hike came with dovish expectations going forward (aka, rate hikes are off the table for a while). But folks, thats not at all how the markets treated Powells comments in December, as air pocket selling and a perfect storm of negativity resulted in the worst December since the onset of the Great Depression.

For those that track seasonal patterns in markets (like us), it also pointed US indexes in the right direction. Asian markets followed our cue from last week with solid 4–5% moves higher.

Not only is January typically a strong month for stocks, known as the “January effect”, where investors buy cheap stocks after tax-loss selling in December, but historical data suggest this month is poised to be even better than normal. That’s because it comes in the third year of the presidential election cycle, which is typically the best for equities.

In pre-election years since 1950, the S&P 500 index has delivered its best returns in January, posting an average gain of 3.9% for the month, according to our friends at the Stock Trader’s Almanac. Part of the reason: Incumbents typically implement new policies ahead of a presidential election in an effort to boost the U.S. economy and make re-election more likely.

One factor that could boost stocks is a thawing in trade tensions between the U.S. and China. Tuesday, Wilbur Ross (Commerce Secretary) was on CNBC and made the point that we’ve made here for more than a year; this is not a trade war…it’s not even about tariffs…this is about China’s rampant IP theft. Ross also stated “these talks WILL result in a resolution into the 3/1 deadline”.

Signs of a strong U.S. labor market and dovish commentary from Federal Reserve Chairman Jerome Powell on Friday helped alleviate some economic concerns and powered our 3% + rally in the DJ on Friday. The FED has been the biggest enemy to investors of late, but this looks to be moderating. Big plus.

Ed Clissold, chief U.S. strategist at Ned Davis Research Group, said he is advising clients to buy industrial stocks and other cyclical sectors such as energy, an area that typically performs well in the latter stages of economic expansions.

“The market doesn’t need a trade resolution to rally, but it certainly would be a big help,” Mr. Clissold said.

And let’s not forget my favorite piece of analytics; since 1946, in the year following mid-term elections, the S&P 500 has been higher 18/18 times with an average gain of 15%.

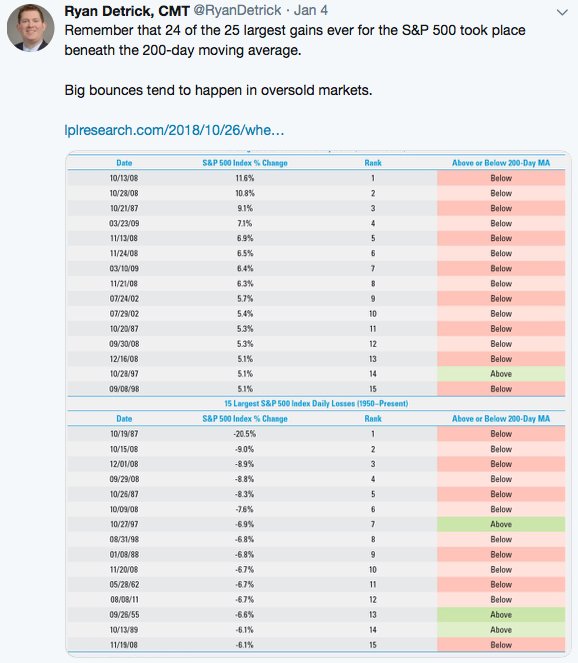

And this piece of remarkable research from LPL. 24 of the 25 biggest gains for S&P 500 have taken place when SPX is “below” its 200 dma. That’s where we reside today…now the battle is on to recoup the 200 dma for our broad market indexes. As we start trading today, SPX is 6% below its 200 dma.

Our view continues to be that December was an aberration. Now take a look at our market internals from yesterday. Better than 2–1 readings in both advance/decline and up/down volume.

Importantly, yesterday marked the first ‘back to back to back” positive readings in the internals since 10/1. This looks to be an important pattern change. We first saw the internals begin to break down in early October…we covered it often here…the readings became brutal and selling pressure followed. Today, we want to see a continuation of another new pattern; “buy the dip”, with the knowledge that this mornings DJ futures are -123 on the backs of weakness in retail. We’ve come a long way in a short period of time…some form of cooling off period and smallish retest should not surprise. But I’ll repeat…the lows are in place…buy the dip is the strategy we will continue to employ.

A great find by bull markets.co. The percentage of stocks above their 200 dma have risen from below 11% to more than 27%, inside of one month, has occurred just 2 times. In both cases, the S&P 500 was sharply higher over the next 3–6–9 &12 months with 1 year gains of 16% and 39%.

And check out this chart of Hong Kong (Hang Seng Index). We now have a higher low with a break above the first downtrend line. China’s markets began to display positive relative strength to US markets in October ’19. When China’s markets get hot, they can get white hot, quick.

Yesterday we saw two home builders (Lennar and KB Home) report disappointing earnings…but that’s not what I was watching…I was watching the reaction in their share prices. Both LEN and KBH finished up more than 8% on the day. Remember, its not the news that matters…its the markets reaction to that news.

XHB (Housing ETF) began to display positive relative strength to the S&P 500 (from 10/19 on) and is up 16% from the 12/24 Christmas eve massacre. Continue to buy housing on weakness. The lows in housing are in place.

Until next time, thanks again for reading…

Kip

Experience the Vertical Research Advisory free for 2 weeks!! For a limited time we are offering a 2 week free trial to the Vertical Research Advisory, visit vrainsider.com for more details.

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

For our latest free updates tune in to our daily VRA Investing Podcast atVRAInsider.comor subscribe to our free blog at kipherriage.com