Chess and Investing. VRA Investing System Update and Our Dominant Investment Themes

/No doubt, many of you played chess growing up. Many of the worlds best investors do. Chess and Risk, those were our games of choice. If you’ve never played a really good chess player, it’s most similar to playing a good poker player…you feel like they’re renting space in your head. I was decent at playing a few moves ahead, but the great players, they see it all.

Many believe that the best chess player of all-time was Paul Morphy, from the mid-1800’s. As a child prodigy he beat many of the worlds best, from the ages 9–12, after learning the game by simply watching his father and uncle play a few matches. Morphy was born to play chess.

In 1858, Paul Morphy played 10 players at once…while blindfolded. He made 250 moves in twelve hours, an average of 27 per game. This gave two minutes for each move and and forced him to form 570 complete mental pictures in twelve consecutive hours, with each picture representing the exact mode in which all the sixty-four squares in a chess board were occupied.

Of course, Morphy won all 10 matches. The event immortalized him as the best ever with the NY Times introducing what may have been one of their first attempts at “fake news” by referring to Morphy as “rumored to be a mystic”. How Morphy must have loved that…

Today, as we battle against Wall Streets computer algorithms and high frequency traders, even a man of Morphy’s talents might come up short. But folks, as we covered in some detail in yesterdays VRA Update, this is why I built the VRA Investing System. This is why I paid close attention some 30 years ago as my mentors taught me how to analyze co’s and personally speak to/get to know CEO’s and mgt teams. Maybe Peter Lynch, the investing legend of Fidelity Magellan fame, said it best; “the best investors invest in what they know.” The VRA System is what I know.

VRA System Update

Labor Day has come and gone…Wall Streets summer break is over. While September has historically been the worst month of the year, lets not forget that the markets just went up 5 months in a row…during some of our most the hostile months, at that (April — August).

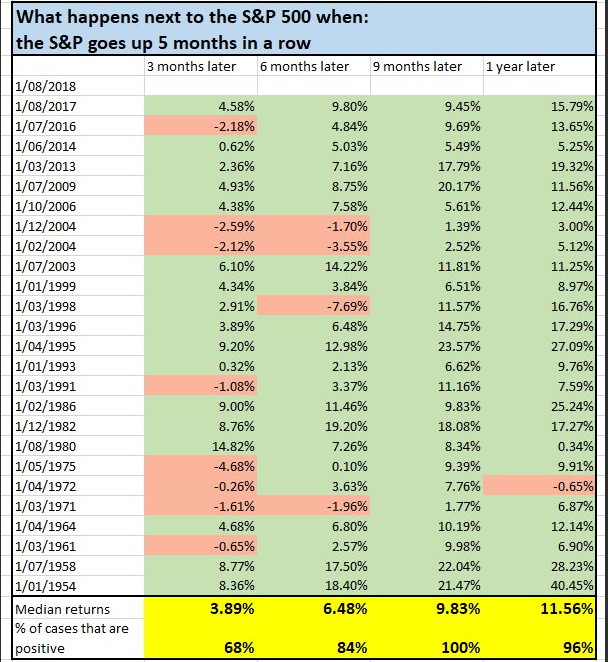

So, what happens next…historically speaking…after the S&P 500 goes up 5 months in a row?

Going back to 1954, following 5 consecutive months of gains, the S&P 500 was higher 100% of the time (over the next 9 months) with a median gain of 9.8% and higher 96% of the time (over the next year) with a median gain of 11.5%.

Yes, the VRA System still sits at “extreme overbought” levels. And yes, from a timing point of view, the time to aggressively buy US broad markets has passed. That time was back in April, when we were pounding the table to “buy buy buy”, once our markets reached “extreme oversold” levels.

Still, as my mentors taught me; “it’s not a stock market…its’s a market of stocks”. And our favorite growth stocks/story stocks remain a “strong buy”.

If you’ve been with us for any length of time at all, you know that we’ve been big-time bullish from the election on. Remarkably, our perma bears continue to tell us that the sky is falling, each time we have an overbought sell-off. Like a broken clock, one of these days they’ll be right. Until then, we will remain long and strong.

As of today, 9/12 VRA Investing System Screens remain bullish. Yes, we remain at “extreme overbought” levels in VRA short term momentum oscillators, meaning that more downside action is possible. But also know this; in major bull markets…like todays…any pause/correction is typically short lived.

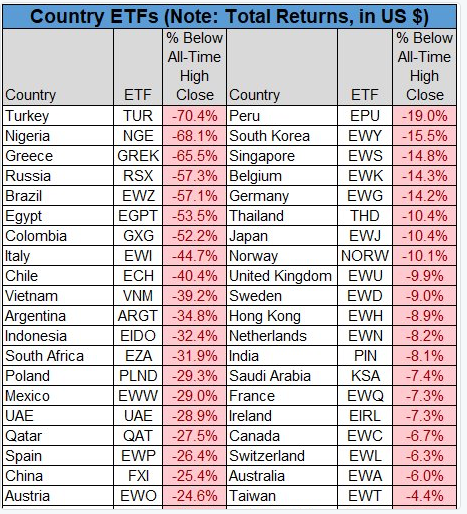

Note: I’m often asked “what’s my biggest concern about the stock markets?” Outside of being blindsided by a “black swan” event…a major terrorist attack, like 9/11….a flash crash…Japan government debt crash, etc., here’s my biggest short term concern; check out the countries with the worst performance over the last year. 10 country ETF’s with 40%+ losses. On this point, I find myself in complete agreement with the perma bears. Should these losses continue to build, my primary working theory that “a rising tide lifts all boats”…the US economy/markets representing the “tide”…could prove to be incorrect. Today, I put the odds at 70/30 that a soaring US economy will lift the rest of the world. The US economy will continue to be be the growth engine for the rest of the planet, just as its been since WW2. But should the losses below accelerate, 70/30 won’t hold for long. Watching closely….

To receive our most up to date, in depth analysis Sign up to join us at the close each day for 5 minutes of everything that matters most…but only if you want to crush the markets with us! www.vrainsider.com/podcast

Tyler recorded the VRA Investing System Podcast yesterday, and it so perfectly reflected both my and the VRA Investing System view that we’re including it here this morning. You’ll hear our dominant investment themes along with our continued views for a sharp rally higher, into year end and ‘19.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 14/15 years.