VRA Update: Positioning for the Melt Up. VRA Macro Themes. Global Chart Analysis.

/Good Thursday morning all. Bit of a pause in US markets yesterday, if you could even call it a pause. Once new all time highs are hit, some consolidation usually takes place. But I don’t expect this pause will last long. We are in the beginning stages of a melt-up in US equity markets. Short term, yes, we’ve reached overbought levels, but I don’t suspect it will matter much. The US economy is just too strong. The US consumer has animal spirits. Stock markets are about to soar.

If you’ve been with us a while, you may remember my most important macro themes:

1) Trump is an economic Godsend. Period. I caught a ton of flack for saying this back in early 2016, then finished my book just as the election was taking place. Becoming Wealthy in the Age of Trump, indeed. Strongest US economy in at least a decade and just getting started. 4% GDP will once again become the norm. Boom time, dead ahead.

2) Nationalism is once again replacing globalism…a more powerful worldwide economic movement you’d be hard pressed to find. True global competition is changing everything. The strong should survive and prosper. The weak must learn from their mistakes, or perish. Pretty simple concepts to understand, but for 3 decades our feckless and corrupted political class forced globalism down our throats. And man, did US jobs, middle class and manufacturing pay the price. Bottom line, this is the single biggest reason that Trump won. Americans knew that our greatness was slipping away.

3) A strong US economy equates to a strong global economy. This has, unquestionably, been the case for as long as anyone reading this has been alive. We have the Greatest Generation to thank for this fact. Here’s what this means; as the US economy continues to surge, it will take most all global economies with it. A return to nationalism, fueling the fire. A rising tide lifts all boats…the US economy as the tide.

Lets go through some global charts this morning. I believe they are confirming that a global boom is building. But first, Aramco has supposedly put their multi-trillion $ IPO on hold. As you can see from my tweet, I’m not that surprised. This global economic recovery will take oil past $100/barrel, which would put another $1trillion + in the hands of the Saudis. No rush…but it will still happen.

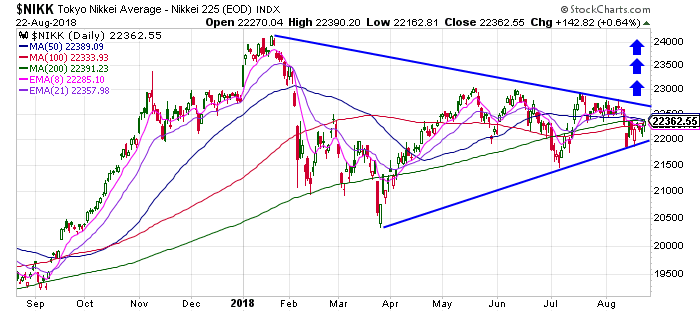

GLOBAL EQUITY MARKET LEADERS. BULLISH PATTERNS BUILDING

1) Japan’s Nikkei. This well defined triangle is building into one helluva a coiled spring. Japan may have lost some economic luster, but with the developed worlds highest Debt to GDP ratio, the world needs Japan to prosper. This chart tells me that a major breakout move higher is coming. Highly bullish for global markets (equity, debt and currency).

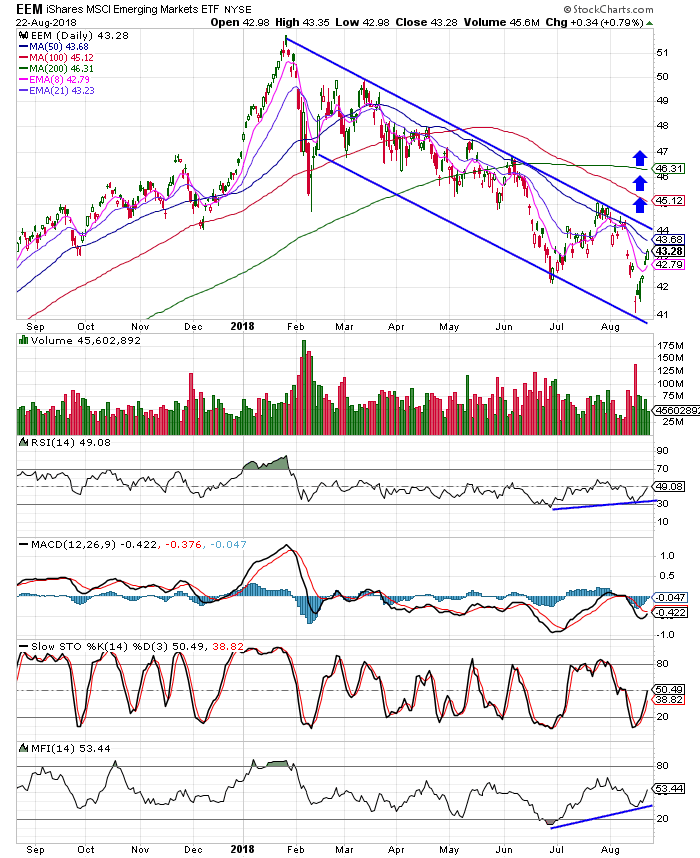

2) EEM (Emerging market index). Trumps takedown of China, plus rising US rates/dollar, have been brutal for emerging markets. Below is a well defined bearish wedge, but should the move higher continue…as I fully expect…once this resistance line is broken we’ll be talking about a falling wedge pattern that has turned to bullish. You know my thoughts here…Trump will strike a trade deal with China prior to the midterms. Likely in the next 30–45 days.

3) Germany. Largest and most important European economy. While I did not draw in the lines here, we see another pattern of higher lows and a developing triangle pattern. Germany has its own share of domestic/political issues, but what they do not have are financial issues. Best balance sheet of any global economic power. Look for Germany to bounce back in a big way.

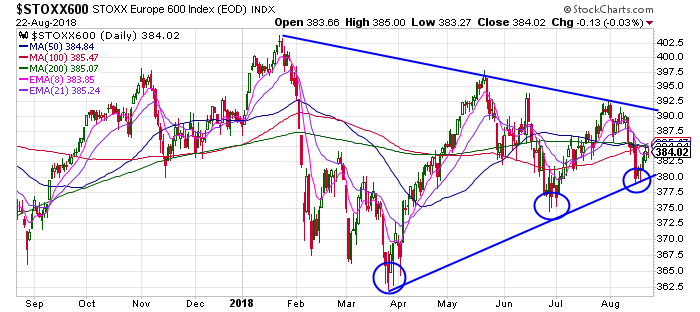

4) Finally, the STOXX 600, made up of the largest 600 co’s throughout Europe. Again, another well defined bullish triangle, developing into its own coiled spring.

Soon, we’ll be out of August and It’s time to make sure we are positioned for the coming melt-up, I expect we’ll see fireworks!

Until next time, thanks again for reading…

Kip

To receive access to our full VRA Membership and daily updates(including our VRA Portfolio with buy and sell recommendations, featuring 2400% net gains since 2014), sign up to receive two free weeks from the VRA atwww.vrainsider.com/14day