VRA Weekly Recap 12/8/17: Market internals and the Fed Rate Hike

/Good Friday Morning All,

After running VRA System scans I can report that last weeks wild trading (from last Fridays flash crash, the market has been volatile) has significantly reduced the overbought status of each US major equity index. Again, we are in the most seasonally bullish time of the year and the (likely) passage of the tax bill is not priced into the market yet. In addition, the mega deal between CVS and Aetna Insurance…$69 billion in size…is almost certainly a sign of things to come.

Remember, the tax bill will bring $2 trillion + back into the US. Repatriation makes a great deal of sense to US multinationals when its taxed at 20% compared to 35%. While I expect most of the incoming cash to be spent on mergers and acquisitions…plus share repurchase programs…without question, a good chunk will also go towards hiring and wage increases.

But there’s also a larger macro point that gets lost in the weeds. Since 1995, the US has lost 55% of all public companies to M&A activity…buyouts and taking companies private. The other culprit of late has been the Dodd-Frank act of 2010. It’s design may have been to minimize future risks from the 2008–2009 financial crisis, but its overly burdensome regulatory effect destroyed the IPO market in the US.

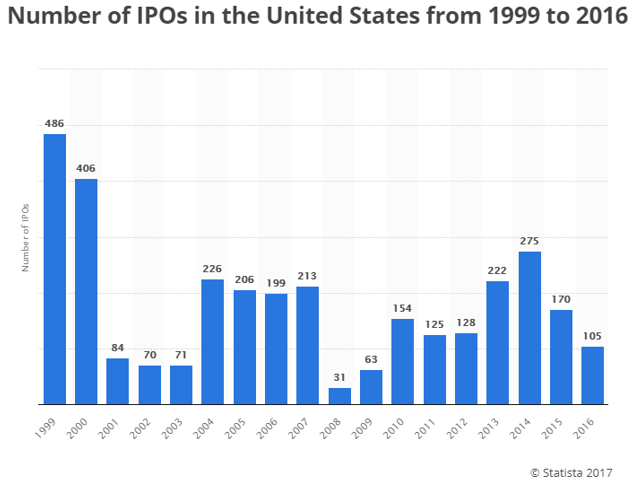

Take a look at the chart below. IPO’s topped out in 1999 at 486. Last year, the number of IPO’s fell to just 105. Going forward, we can expect a sharp increase in IPO’s…its another of Trumps goals.

The larger point here is that the 55% drop in publicly traded US co’s has resulted in a supply/demand imbalance. The investment markets are approaching $100 trillion in total size (globally), meaning that we have far more money chasing far fewer public co’s. HIGHLY bullish for stock prices going forward…it also helps to make sense of todays higher P/E multiples.

You know my thoughts. DJ 25,000 by year end. DJ 35,000 by end of 2020.

Market Internals

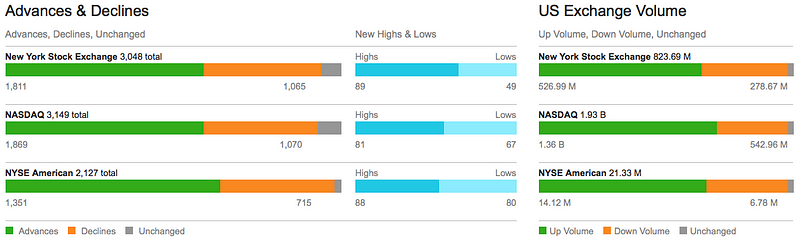

The rotation out of tech and into value continues. The tech heavy Nasdaq has been weak, but no, I do not expect the weakness to turn into a sharp sell-off. The markets internals are holding up just fine. Take a look at yesterdays closing numbers. While New Highs & Lows volume were mixed, the number of Advance/ Declines was very bullish.

For this market hiccup to evolve into a more serious pullback (even in stocks being rotated out of), these kinds of powerful market internals will have to begin weakening…quickly…I simply do not see this in the cards.

Markets that refuse to demonstrate weak internals, even during negative news like both of this past weeks “fake news driven declines”, are telling us that they want to continue moving higher still. Here are yesterdays closing internals, on what was a flattish day.

2–1 positives across the board. I’ll be as clear as I can; these are not the internals that we would expect to see in a market that wants to go lower. Add in the fact that we are in a highly bullish seasonal period…in fact the most bullish of all…and its highly likely that last Fridays flash crash lows will be the lows for some time.

We’re also seeing new all-time highs in housing, financials and the transports. Just not at all the kinds of market action that we would expect to see in a market (or economy) that is about to change direction.

AAII Investor Sentiment Survey

Below is Wednesday’s weekly AAII update. Bulls at 36.9%, bears at 34.2% and neutral investors at 28.9%. Bull markets end when bulls are hitting 60% and for weeks on end. Until we have the final ‘lift-off” stage in the stock market…the same one that I believe will take the DJ to 35,000 or more…I see no significant top in the stock market.

FED Meeting and Rate Hike

The FED meets next Tuesday and Wednesday…they’ll then announce their rate hike on Wednesday at 2PM EST. And yes, the FED is going to raise rates, barring a major surprise. In fact, if the FED does not raise rates, I would expect the market to sell-off a good deal. The markets do not like surprises…as we’ve seen in the last weeks trading sessions with TWO fake news stories about the Trump administration (ABC news fake news on Friday and the fake news that Mueller has subpoenaed Tumps bank records…also fake news).

IMPORTANT: the action we are seeing in the markets…which features what I can only call bizarre trading anomalies…is taking place in front of the FED’s expected rate hike next Wednesday. Emerging markets, like China, are being taken to the woodshed. We’re seeing the same in precious metals, miners, industrial metals, energy, etc….the global relation/inflation themed names.

Because we have seen this exact action take place before the last 4 rate hikes, we also know what the outcome will almost certainly be resolved higher. IF NOT, then this would represent a pattern change…I see a 90% probability that there will be NO pattern change (because at this point the markets, especially rates and bonds, are hinting at a slowing global economy…possibly even a recession). I see the odds of this as tine, meaning that the current correction in global relation themed names is giving us a gift here

I also expect the current sell-off in PM’s and miners to end within the next 48–72 hours or so….in the next 2–3 trading sessions.

Final point on precious metals and miners; increasingly I am increasingly hearing from clients and traders that they have been selling their gold and buying Bitcoin. Frankly, who can blame them? Bitcoin is trading at $15,896 as I write this morning. The manipulators have yet to find a way to manipulate cryptos…of course they’ve been doing this to gold/silver for decades. GOLD SHOULD BE DOING WHAT BITCOIN IS DOING…and it should be over $5000/oz today.

For my subscribers(click here to receive 2 free weeks), in our next update, as we get closer to the FED’s hike, I will show you exactly what I am talking about. The price suppression in PM’s is criminal. It’s robbed us of bitcoin-like gains…of this I am beyond certain. But this suppression is about to end. 2018 will tell the tale…and its this final pre-rate hike selloff that will remove the final weak hands in precious metals and miners.

As to Bitcoin, its in parabolic mode right now. This is when huge moves higher take place, almost universally followed by sharp selloffs. But bubbles can take on a life of their own…this one could take bitcoin higher still. Also know this; the public is now rushing in to buy Bitcoin…this typically marks the beginning of the end of the current move. I have no idea where that top may be…as long as investors are properly diversified, Bitcoin still has a place in a portfolio. But gold is a far smarter investment today…especially with the post rate hike recovery move higher that I see happening.

Until next time, thanks for reading… have a good weekend

Kip

To receive two free weeks of the Daily VRA Updates, sign up at VRAinsider.com