VRA Investment Update: Second Quarter GDP Recession Confirmed

/Good Thursday morning all,

Q2 GDP — Recession in the US

Second quarter GDP just came in at a negative .9%, meaning back to back negative quarters and the technical definition of a recession. First, I owe Wayne Root a Las Vegas dinner. He was so confident that GDP would be negative that he wanted to bet $1 million on it. I’ve learned to never make large wagers with anyone that confident. Helluva call Sir WAR.

Second, as much as this definition of a recession is not actually the official definition (that’s NBER), does anyone reading this believe that the media would give Trump that break were he still in office? Not a chance!

VRA Bottom Line: the US just entered a recession. It was always going to happen with Biden as president…there will be zero shocked faces today. Here’s the good news; history tells us that by the time a recession becomes official, the markets lows are already in place and the recession is essentially over. The markets lows may well be in place but I have my doubts that this recession is over. Especially when its intentional.

Regardless, get ready for Team Biden to spin the sh*t out of this GDP # today. We should all be prepared to laugh in their collective faces.

J Powell, Blink Twice if You’re Being Held Hostage

Besides the .75% Fed rate hike, exactly what did we just witness yesterday? As a Bloomberg host said after the rate hike and Powell’s presser, “Powell looked like he wanted to be anywhere except in front of that mic”.

If you’ve been reading our work, you know that we got exactly what we wanted; a (very) dovish Fed with no fewer than 5 major statements that screamed “everything has changed”. Gone are the threats of nonstop rate hikes into 2023. Gone is the strict language of “whatever it takes to stop inflation”, and gone is the Fed’s forward guidance.

Instead, here’s what we heard from the money printing rock star himself:

“Growth and consumer spending are clearly slowing”

‘We might have a handle on inflation and rates could already be at neutral”

“Job creation is slowing”

“We’re now data dependent and making decisions on a meeting by meeting basis with rates at neutral”

“We’re not in a recession” (HA…and he claimed not to have seen the GDP # in advance…does anyone believe that?). THIS is why JP was so dovish….he knew what was coming this morning. Obviously.

It took all of about 5 minutes after Powell started speaking for the markets to start melting up (nasdaq was already up 200) led by the semis and tech…absolutely textbook.

Who was this J Powell and where have they been hiding him? My spidey senses were telling me; “somebody on Team Biden got to the Fed. They can live with high inflation headed into the midterms…but they can’t live with a deep recession…it was time to get the market melt-up into the midterms underway.”

And once again, someone on Team Biden leaked the Fed statement to their Wall Street buddies. By my count this was the 4th time (minimum) that important economic data was leaked. Two CPI reports, one jobs report and then yesterday. When you’ve been around a while you know what to look for. When the markets move in exactly the direction that the data would point to, you’d have to be extra naive not to know it was leaked…again. If this were happening under Trump the screams for impeachment would reverberate across MSM. But this is criminal activity. Pure banana republic stuff. But it’s the Dems, so no biggie. Our system is broken.

I’ve been hyper-critical of this Federal Reserve and J Powell. They’ve deserved it. But not yesterday. Powell and team did exactly the right thing. The US economy is in a recession…animal spirits are gone…everyone feels it. But first we got the $280 billion semi/tech bill out of the Senate on Tuesday, then we got exactly the right news from the Fed. The end result is a market that should keep moving higher. I do not believe it will stop. If I’m correct, we are no longer fighting the Fed.

I’ll be AMAZED if they hike again when they next meet in September. My forecast for the last 9 months was that if the Fed hiked the Fed funds rate beyond 2% (it’s 2.5% now), a recession in the US was inevitable.

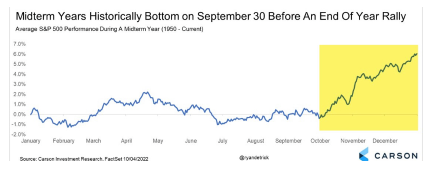

That means this market should keep heading higher…it also means that its entirely likely…if not probable…that we’ve already seen the final bear market lows.

And here’s why; once the stock market starts plowing higher, animal spirits quickly return. The wealth effect begins to kick back in. Those 401K statements start getting easier to open. And it also opens the door for my theory that Joe Biden might just pull off a Bill Clinton…moving back to the center and leaving his commie-radical base in his rear view mirror. Yes, I know how crazy this sounds.

VRA Bottom Line; the move higher into the midterms should be “ON”, led by short covering and near record amounts of cash on the sidelines. Semis and tech will lead but this should be an “everything” move higher. I especially like precious metals and miners here. This group has been destroyed. But as the US dollar continues to reverse lower (hyper good news for emerging markets and Europe), and as rates keep plummeting, gold, silver and the miners should zoom higher. Base metals as well.

We’ll want to treat this like it was a “reset”…the onset of a “reflation trade”.

And yes, a melt-up move higher might just be good enough news to keep Dems from being absolutely demolished come November. Did you really think they were going to play fair?? Because that’s the look that J Powell had yesterday. Everyone has a boss. Powell's boss is the ruling class, AKA the Uniparty. Must. Get. Uniparty. Re-elected.

As seen below, the S&P 500 zoomed through 4000, breaking a trend line that’s been in place since early May. There’s no real resistance until we reach 4150.

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Truth Social and Rumble