VRA Investment Update: Fox Business; When The Generals Lead, the Troops Fall in Line. Inflation Does Have An Upside.

/Good Thursday morning. Charles Payne of Fox Business had me back on his show ‘Making Money’ yesterday and the events surrounding it were interesting. Here’s how it works: First, one of Charles producers emails you a day or two before and ask if you’re available for the show. Second, they ask you to send over your latest “hit” (VRA Letter). I’m assuming they do this so they can see whether or not what you’re saying is interesting and/or worthy of being on air. Third, they let you know whether or not you’re officially invited onto the show.

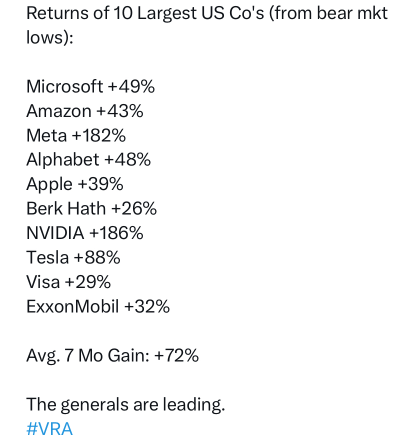

Following their request I sent over our research, which included this breakdown of the 10 largest American co’s, showing that the “average” move higher in each is 72% (in just 7 months).

Almost immediately after sending this over here came the emails from one of his producers, with questions like “wait, are you saying this is bullish? Because everyone we have on the show is saying this is bearish?”

Folks, how perfectly does that question fit into our contrarian narrative? Investors, media, etc (across the spectrum) are having a hard time making this new bull market compute.

Finally, when the show started, this was one of Charles first questions; “so you’re saying this big outperformance by just the 10% largest co’s is bullish, because most everyone we talk to says its bearish”

Yes, that’s exactly what we’re saying. When co’s worth $500 billion to more than $2 trillion are jumping by an avg of 72% in just 7 months, the set-up could hardly be more bullish.

When the generals lead, the troops eventually fall in line. AKA a rising tide eventually lifts all boats.

BTW, I know Charles well enough to know that he’s a big time bull. He hates being bearish…but he’s also required to show both sides, on air. Charles is one of the really good guys. Based on is childhood and where he’s come from it’s just an extraordinary story to get to know. I can’t root hard enough for people like Charles Payne.

Nvidia (NVDA) Destroys the Quarter

Man of man did we get more evidence of the generals leading yesterday when NVDA reported Q1 earnings. Because of demand for anything innovation-related, specifically AI chips with 1000’s of applications, NVDA crushed Q1 earnings and provided insane guidance going forward. NVDA shares are trading up 29% as I write. I think its important that we understand the magnitude of what’s happening here. NVDA was a $725 billion company (mkt cap) going into earnings and inside of 18 hours just saw its valuation jump by $250 billion. Holy innovation/AI melt-up batman!

** Nasdaq futures are up 300 points.

VRA Bottom Line: we have entered what may prove to be the most explosive bull market since the dot-com melt-up. Cathie Wood (ARK Funds) was right all along. Innovation and AI are changing everything.

While its true that key segments of the market have hit extreme overbought readings on our VRA Investing System, for the longer term health of this young bull market we’re beginning to see solid improvement in the areas that have had the bears remaining so negative on stocks. This is the nature of a young bull market; gains continue to broaden, the technicals continue to improve, and price action marches higher, making it increasingly difficult for bears to maintain their narratives. Things just keep getting better.

Here at the VRA we’re not permabulls or permabears. We have no problem being bearish, if that’s what our research points to. But we turned aggressively bullish on 10/13/22 and we remain positioned that way today.

Corporate Earnings and the US Economy Remain Solid; Yes, Inflation Has its Upside

This is a topic that’s being missed, almost entirely, by the mainstream financial media. In our new book “The Big Bribe” we outlined the financial engineering taking place that will send the economy and markets sharply higher into 2030. Inflation is part of that financial engineering. Inflation is a term used to describe the general increase in prices of goods and services in an economy over a period of time. While inflation is often viewed as a negative economic phenomenon, it can actually have several benefits for an economy (managed properly).

1) Inflation encourages investment and spending. When prices are rising, people are incentivized to spend their money now rather than later, as they expect prices to increase in the future. This can lead to increased demand for goods and services, which in turn can drive economic growth. Additionally, inflation can encourage investment, as investors seek to protect their wealth from the effects of inflation by investing in assets that are likely to appreciate in value.

2) Inflation boosts economic growth. When prices are rising, businesses can increase their prices and profits, which can provide them with the resources they need to invest in growth and expansion. This pricing power is being witnessed today in earnings beats of Q1. Additionally, inflation can lead to increased employment, as businesses may need to hire more workers to meet the increased demand for their products and services.

3) Inflation can reduce our debt burden. When prices are rising, the value of money decreases over time. This means that debts that were incurred in the past become less burdensome over time, as the real value of the debt decreases. This can provide relief to individuals and businesses that are struggling with high levels of debt.

4) Inflation encourages wage growth as workers demand higher wages to keep up with the rising cost of living. This can help to reduce income inequality and provide workers with the purchasing power they need to maintain a decent standard of living. The fall survey by research firm WTW had average estimated salary increases rising to 4.6%in 2023 from actual pay rises of 4.2% last year. A Conference Board poll highlighted a similar trend, with budgets for salary increases rising to 4.3% from 4.1% last year.

We know the negative effects of inflation; reduced purchasing power, decreased consumer confidence, and increased uncertainty. We’re seeing that uncertainty now, along with the Fed’s 10 straight rate hikes. But there are potential upsides as well. I think that’s what we’re seeing today in the form of Q1 earnings beats and a still resilient economy/markets (both here and abroad). It’s a story we’ll stay on top of. We enjoy researching the contrarian view.

VRA Final Thoughts: We think the bears have it wrong. We’ve come from abject fear…to a rising tide lifts all boats…to the train is leaving the station (where we are now)…to a bull market that will ultimately turn into “FOMO” (Fear of missing out). Again, this has been a (mostly) textbook (early) bull market but we are in a new bull market nonetheless. Bull markets love climbing a wall of worry. We remain long and strong as we continue into the best year on record (presidential pre-election years are hugely bullish). As always, we’re keying off of the semis, housing, transports and the generals. We have been aggressively long from the 10/13/22 bear market lows and will likely remain long, relying on the VRA Investing System to tell us when to take profits and/or add to/reduce positions.

Until next time, thanks again for reading.

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast! Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble