Ugly Action, Seeking Capitulation - Quick Hitters

/Good Friday morning all. After Wednesday’s 2–3% ramp higher (S&P 500, Nasdaq, R2K) it sure felt like the lows were in as we had a 90% up-volume day in NYSE with 7:1 advance/decline and as S&P 500 put in an outside day (technical buy signal).

Then, news broke that Apple decided not to increase production levels on their new iPhones, followed by BofA’s downgrade on the stock from buy to a hold rating. Just like that, Apple fell 5% and took tech/semis and the broad markets indexes with it. All of our major indexes finished lower yesterday, and the Semis (SMH) hit new lows for 2022. Seeing the semis hit new lows is not great…Apple news being the culprit.

We continue to expect a near-term move in the other direction (higher) for US stock markets. Here’s Why:

VRA Quick Hitters:

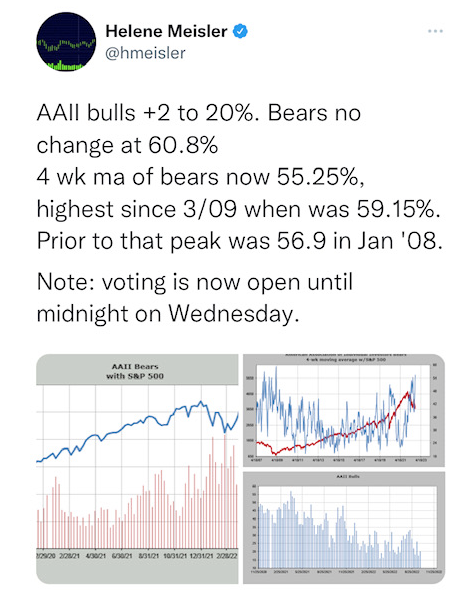

1.) We learned this week that the AAII 4 week moving avg of bears just hit 55.25%, the highest reading of bears since the financial crisis lows of March 2009 (which marked the bottom).

The AAII sentiment survey also just put up back to back weeks with more than 60% bears. Thats never happened before in the history of the survey (1985) and which I’ve voted in since 1988.

Before this week more than 60% bears had happened only 5 times and the avg move higher in S&P 500 was 33% over the next year.

2.) We are about to wrap up the worst month of the year, which beginning on Monday will be followed by the best month of the year (in midterm years) along with the best quarter of the year (Q4).

Monday, being the first day of a new month and new quarter, will also bring with it significant equity inflows as well.

Also, remember this, in just over a month (midterms) we enter an extraordinarily bullish 12 month period, where since WW2 the markets have been higher 100% of the time with an avg gain of >15%.

3.) The US Dollar had an outside day yesterday…what is called a “bearish engulfing candle”. These often result in a reversal move lower. if so, big for stocks and dollar based commodities (gold, silver, oil, copper, etc). Not a guarantee the top is in just yet, but the one-way dollar trade is starting to look very extended IMO.

4) This morning economist Jim Paulsen, another of our favorites, was on Bloomberg, reiterating that the Fed has gone too far and that stocks are a big buy here. His primary points:

- Cash is not the place to be

- Looking for a rip in stocks

- Early cycle stocks. Consumer discretionary & growth/tech. Small cap growth stocks are a great buy.

- Dollar is too high (good short)

- Really close to a Fed blink. Something is close to breaking.

- Powell’s Volcker moment after 15 yrs of inflation?

- US corp and consumer balance sheets are in great shape with cash and liquid with banks squeaky clean.

5) Of note, our FIFO stocks (first into bear market, first out of bear market) are still holding up above their bear market lows.

- ARKK is still 8% above the lows.

- XBI 25% above lows.

- KWEB 20% above lows.

FIFO is still holding up.

Yesterday was ugly but not as ugly as Wednesday was pretty.

6) Lastly, here are the bullish theme’s we have been covering with VRA Members

- We’ve hit extreme oversold on the VRA Investing System on each major US equity index.

- Put/call ratios hitting “reversal” levels

- BofA global fund managers have more cash than at any point since 2001.

- Investors have $5 trillion in cash in money markets accounts and mutual funds (record)

- The DSI (daily sentiment index) is at “5” for both the S&P 500 and nasdaq. AKA extreme oversold.

- Investors globally are saying “what if”. “What if we have WW3 and nuclear war….what if currencies collapse…what if a global crash takes place…what if the Fed is crashing the system intentionally, etc”.

I’m not saying that these risks aren’t real…because they are. What I’m saying is that over my career, when investors get this overwhelmingly bearish and start asking the ‘what if” questions it has meant we are near a significant turning point.

- And yes, team Biden absolutely wants the stock market moving “higher” into the midterms.

At this point it’s time for the question to be asked; “Do J Powell and his merry band of money printers at the Fed actually WANT Democrats to be wiped out in the midterms?

As Compelling as Compelling Can Be; Stocks Must Be Owned Headed Into the Midterms

Until next time, thanks again for reading….

Kip

Join us for two free weeks at VRAInsider.com

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

Also, Find us on Truth Social and Rumble