VRA Weekly Update: Excess Liquidity and Surging Corporate Earnings = Liftoff. Semis Will Lead a major Market Move Higher Into June.

/Good Thursday morning all. This feels as much like a goldilocks market as I can remember. You know the reasons we’re bullish…the reasons we’ve been aggressively bullish for the last 14 months…but its primarily about two issues. These are the most important two issues of any bull or bear market; liquidity and corporate earnings. And we’ve never had this much global liquidity. Not close And here’s a question we see few asking that we think is broadly important; Can you imagine where our equity markets might be without the “many” trillions in liquidity that have been diverted “away from stocks” and instead into Cryptos, SPAC’s, NFT’s, etc?

This excess liquidity is a clear sign of the massive move higher in stocks that awaits…and we have surging corporate earnings to back it up. As Evercore and Ed Hyman have been pounding the table, the markets do not peak until earnings peak. Their target for a peak in S&P 500 earnings? 2025+. Matches ours. We must remain long and strong. Certainly as we enter the last week of May (huge equity inflows), followed by the last month of Q2 and those massive Q2 earnings beats that are headed our way.

Our best bull markets are always led by tech. Each time we have a correction in tech the bears pounce, screaming that tech is dead. Hardly. Instead, many SPAC’s are dead…most never should have gone public, certainly not at their outrageous valuations. But now its time to focus on real tech…you know, the semis, Q’s and big tech.

This chart of SMH (Semi ETF) is key.

SMH has a double top in the 258 range that must be dealt with but SMH has also broken up and out of its month long downtrend line…on BIG volume…and is now clear of every moving average that matters. It also has a new MACD buy signal and is light years from hitting overbought levels. If SMH can break through the double top at 258 (high odds), the target becomes $300, or 22% higher from here.

This may be the best Goldilocks market that I can remember in some time. Really think this is the case. First we had the big capitulation in tech stocks on May 12th (with hedge funds and fund managers puking up tech/growth and even going aggressively short…right at the lows), followed by last weeks capitulation in Bitcoin, giving us a great set-up as we head into end of month, featuring massive equity inflows and share buybacks as we kick off the month of June.

And man is there ever a lot to be excited about in the month of June. It’s the last month of what will be the best quarterly earnings beats on record. This years Q2 comps compared to the CV insanity lows of Q2, 2020?? Holy melt-up, here we come.

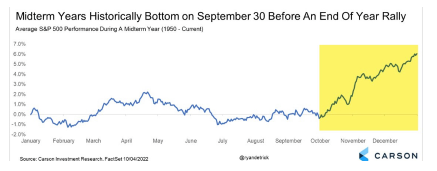

And this from Ryan Detrick. Really helps us with the quant side…the analytics point to a strong finish to 2021.

When the S&P 500 is up more than 10% by the 100th trading day of the year (it finished +12%), the markets are higher 84% of the time with an average further gain of 8.6%.

And yesterdays internals were a smoke-show of bullishness. 3:1 advance-decline in Nasdaq with 76% up-volume. NYSE up-volume was an even bigger 78%.

And the Russell 2000 was up 1.9%. That’s important…small caps have lagged. Now, with tech leading once again, let the short covering melt-up move higher resume.

Precious Metals and Miners

We love us some gold, silver, copper and miners here. And it’ll be driven by this crazy amount of excess liquidity in place, negative real rates that continue to get more negative and never before seen levels of currency inflation, AKA fiat currency printing.

3 years ago the VRA began targeting MUCH lower interest rates, even as the 10 year yield was hitting 3.2% and PHD economists were warning of 5%+ yields. But we saw negative rates in Japan and Europe and new that it was a physical impossibility that US rates could remain anywhere near 3%. Simple gravity. Frankly not even a bold call. But when I announced that our target for the 10 yr was sub 1% yields I was essentially laughed out of the room.

Of course we were right, as the 10 yr fell below .50% near the depths of CV insanity.

And folks, the story really hasn’t changed all that much. Europe and Japan still feature negative rates and yes, gravity is still a thing.

Next up; even as tapering by the Fed begins, watch as rates go even lower. Those same PHD economists will excuse it away by saying “without as much QE of course the economy will grow more slowly….hence lower rates for longer”. It’s coming folks…just remember where you heard it first.

And the lower rates will send precious metals and miners to the moon.

VRA 12 month targets: Gold: $3000/oz, Silver: $50/oz.

We must remain long and strong. The VRA Portfolio of 60% growth and 40% value feels right to us. Crush Mr Market right.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Twitter