VRA Investment Update: The Rubber Band, Stretched Too Far. Semis; Extreme Oversold on Steroids.

/Good Thursday morning all.

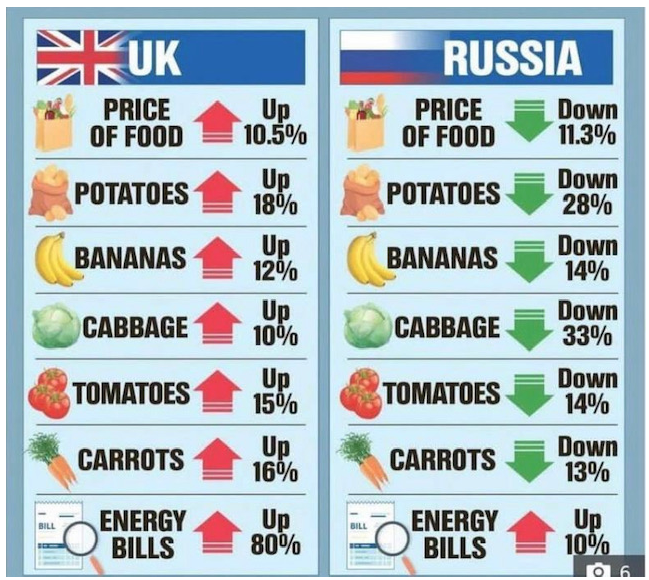

Following last Friday's jobs report the markets moved sharply higher, only to give up all of its gains and then close lower by 1% across the board on concerns that Russia would cut off European gas supplies (which happened). However, its my view that this news is baked in the “fear cake”….another “buy the rumor sell the news” event that we believe will send this market higher from here.

Folks, everyone is SO bearish on Europe…and frankly the US as well…that I’ll be surprised if we see much more downside from here.

Did you see the massive rallies throughout Europe over the weekend, protesting high gas prices, giving more money to Ukraine and the war itself? Major support is building for Russia. The people of Europe have seen enough. Let’s see if it makes a difference. This was all over social media throughout the UK over the weekend. We feel your pain, UK.

Two points on US Markets

1) no, the US is not in recession. Just not possible with unemployment rate of 3.7% and more than 300k jobs being produced.

2) yes, we can absolutely expect unemployment to rise, but not by as much as the permabears expect. The Trump Economic Miracle is still in place. It was constructed to power the US economy for more than a decade, and with Trumps tax cuts and deregulation still in place (yes, most of Trumps economic policies are still intact) and his anti-China, America First policies still bringing China to their knees and the “reshoring” of US jobs a VERY real thing, the gloom and doomers still have it wrong on the US economy.

Caveat; yes, we have an America-hating President that was installed in 2020. God knows hes doing everything possible to tear down the economic miracle that Trump built, but if his address to the nation last week is any indication, no one is listening. When even your besties in MSM refuse to carry your prime time address, you know your reign is ending. Imagine that; when you call half the country domestic terrorists and threaten the use of F-15’s against them, that message actually turns people off. What an absolute loser.

Let’s Go Brandon. The midterms are just 2 months away. Get ready for a red-pilled America to make their presence felt and for absolute gridlock in DC (the markets love DC gridlock). My wish remains; make Trump Speaker of the House. PPV the House hearings and pay off the national debt.

VRA Market Update

Roughly 3 weeks ago we began advising that the VRA Investing System had reached the broad market designation we refer to as “extreme overbought on steroids”, our most overbought readings and when bad things tend to happen in the market. Because we expected the pause/pullback to be just that, and not the resumption of a major new move lower, we only recommended pausing any new purchases of our broad based market ETF buy recs (we always use monthly dollar cost averaging to add to our VRA 10-baggers).

But today, the script has flipped. We have reached the same level of extreme oversold (Short term) that we hit just before the markets bottomed in June. We are buyers here.

Take a look at our market leader, the semiconductors (SMH)….because we are essentially there…a hair away from extreme oversold on steroids. Each of our VRA momentum oscillators (RSI, MACD, Stochasics and MFI) are red-lining extreme oversold (only RSI has a bit of daylight left).

The SMH rubber band has stretched about as far as it can go. We are right at the point where significant moves in the other direction take place. In addition, the descending blue trend line that’s been in place since late March and has acted as resistance should now act as support. SMH remains some 8% above its bear market lows of early July.

We look for this “higher low” to hold and for SMH to reverse higher from here.

GOLD: Helene Meisler, one of our long term favorite market watchers and technicians, put this chart out of gold over the weekend.

In early March, gold had a bearish island reversal. On Thursday, gold had a bullish island reversal. We remain in the most bullish time frame of the year for gold.

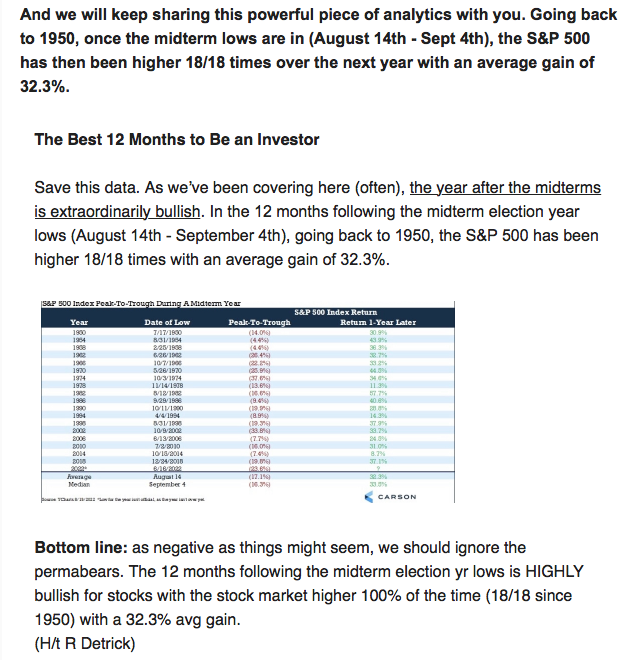

Finally for today, I once again must post the most powerful set of analytics of my career.

The markets LOVE moving higher once the midterm lows are in. WOW.

Until next time, thanks again for reading….

Kip

Please join us each day after the market closes for our Daily VRA Investing Podcast!

Sign up for email alerts @ vrainsider.com/podcast

And check Out Our Latest (now daily podcast!) Videos on Rumble