The Most Hated Bull Market of My Career. Stunning Investor Sentiment Readings. VRA Investing System Nearing 11 of 12 Screens Bullish.

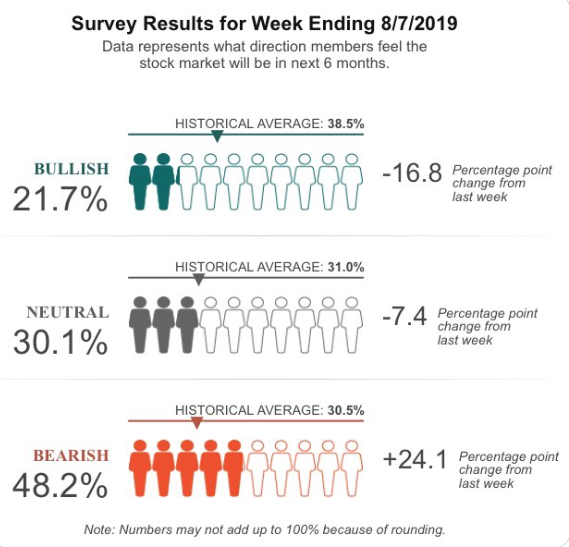

/Good Thursday morning all. To give you an idea of just how out of whack investor sentiment is, with US markets just 5% or so away from all time highs, check out last nights AAII Sentiment Survey reading.

21.7% bulls (down 16.8% on the week) with 48.2% bears (up 48.2% on the week). Over my 34 years of doing this…and I’ve voted in this survey for 30 years…these readings are more evidence of our long stated belief that this is the most hated bull market of my career. Folks, this is not the sign of a market top. This is the sign of a market that wants to roar higher. Investor sentiment is that powerful of a force. 21.7% bulls are just (barely) off the low readings from the week of the 12/24/18 capitulation.

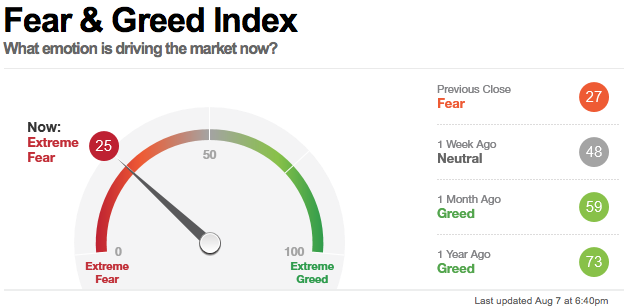

We see similar readings in the Fear and Greed Index, with a reading of 25 (extreme fear). While not near its all time low readings of 1 (yes ONE!), from 12/24/18 (the single biggest buy signal of my career), a reading of 25 confirms AAII readings just fine for us.

The VRA Investing System sits at 10/12 screens bullish…we are very close to moving to 11/12 screens bullish. If the Russell 2000 and transports were above their 200 dma, we would be 11/12 today. The VRA System has only hit 11/12 screens bullish twice in its history. In Parabolic options we added two call positions over the last two days. SMH and QQQ. It’s likely that the lows for the year are in place.

What’s the one goal of central bank rate cuts? To stimulate economic growth. Exactly how do rate cuts begin the process of stimulating growth? They force money out of bonds, into equities. With central banks cutting rates all over the world, all we have to do is follow their lead. It’s TINA time folks. There Is No Alternative to stocks.

Of course, these global and coordinated rate cuts are extraordinarily bullish for precious metal’s and miners as well. Remember this from our recent updates; the best bull markets for Pm’s and miners occur at the same time that stock markets are soaring. That’s exactly where we are today.

Note: as we return to “risk on” mode, don’t be surprised to see precious metal’s and miners take a breather. Trees don’t grow to the skies. I expect any pause will be just that. Take a few minutes to watch this video from Bill Murphy, head of GATA. Bill thinks a sizable default on delivery could be underway right now. Know this; Bill is the man. No one knows the criminality and fraud of the manipulation of the PM market better than Bill. After you watch this you will know more about the PM market than 99.9% of Wall street gurus or CNBC talking heads.

https://www.youtube.com/watch?v=BfTvQb2PZ-Y&feature=youtu.be

U.S.- China Trade

If China is the biggest risk to US markets, we have almost no downside risk. Not really….not beyond a ST (early August) selloff.

I’ve made it a point to understand Trump. Here’s what I believe is happening. Trump is ramping pressure…putting the fear of God into China. Communists back down to one thing and one thing only…power.

China has no real power. Again, not really. I’ve written about this often over the years…the only power China enjoys came from 2 decades of weak US/global leadership that enabled China’s theft of other counties GDP.

Look at whats happening in Hong Kong. Mainland Chinese leadership….Xi and team…believes that Hong Kong protests are taking place due to US interference.

They’re almost certainly right. If China takes the bait…as in another Tiananmen square from 1989…China will lose control. Protests will spread to mainland. This is a communist countries biggest fear.

Look, all of this is potentially risk off news. I’m not blind to that. But this is also when trend followers get paid. Buy the fear.

Until next time, thanks again for reading…

Kip

Since 2014 the VRA Portfolio has net profits of more than 2300% and we have beaten the S&P 500 in 15/16 years.

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast