VRA Investment Update: Smart Money Hour, New Pattern? No Recession."Insane EU Energy Agenda."

/Good Thursday morning all. Tuesdays afternoon comeback was impressive (coming off of a near no-bid open…real fear) led by Nasdaq’s 400 point swing higher, and we got a glimpse of that yesterday as the Dow went from -150 to +220 in less than an hour, marking back-to-back afternoon reversals higher. This is the pattern change that we want to see emerge. Nothing makes the shorts more nervous than this kind of late day action.

Inflation is clearly plummeting and likely economic growth along with it, although yesterdays ISM services data beat estimates with a better than expected reading of 55.3 (recessionary fears kick in with sub 50 readings).

This week’s trading looks like there is less concern about inflation but with growing fears of a significant economic slowdown. Oil was down because of concerns that demand is dropping due to a sharply slowing economy but there are still inflationary pressures in food and other areas, so the danger of stagflation remains real. Weakness in the Euro is a particularly good indication of how fears of a recession in Europe are gaining traction. Putin appears to be winning on all fronts and Western leaders hardly seem to care less about the hardships their own people are experiencing. The situation in Europe is much worse than in the U.S., with the UK almost certainly already in a recession.

Without question this mood is impacting U.S. markets, even as our economy has held up much better than other parts of the world. The data to date does not support a recession in the US, but with Biden as president it will frankly be a shock to me if we avoid one. Still, the economists that tend to get it most right (Ed Hyman and John Paulsen among them) simply are not seeing a recession in US; not with unemployment at 3.6%, home prices near record levels, a transportation industry that is still zooming and consumer net worth right at all time highs.

Again, Ed Hyman, the economic guru at Evercore, sees a slowing US economy with inflation that is absolutely easing but still sees no recession in the cards…but he may also be sending a message to Fed Chair J Powell (who its rumored reads Hyman’s work). A message something like this: “pay attention to the data JP…because it is quickly changing…or you’ll risk sending the US into a recession”.

The overall market is in bad shape…this has been an ugly bear market…but there are components that continue to impress, with strong relative strength from the exact ETF’s/indexes that started their bear market in 2021. We in fact have had a rotational bear market for more than a year with the indexes covering up the weakness in most stocks.

Will we now see a reversal of the action with FIFO (first in, first out) continuing to lead the way higher? From ARKK (Cathie Woods Innovation ETF) to XBI (Biotech ETF) to IPO (Renaissance IPO ETF) to KWEB (China Internet ETF), each of these market leaders (pre 2021) that first led the way into this bear market, then went on to bottom on 5/12/22. Those lows have held. We continue to find this interesting and the longer it goes on the more likely that it may represent an important market tell.

This market is so hated…from most every point of view…we are due for one rocket ship of a bear market rally.

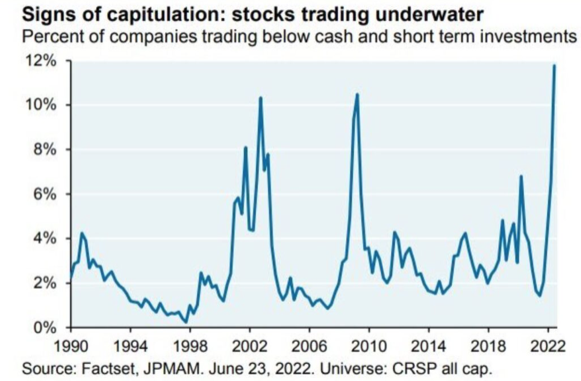

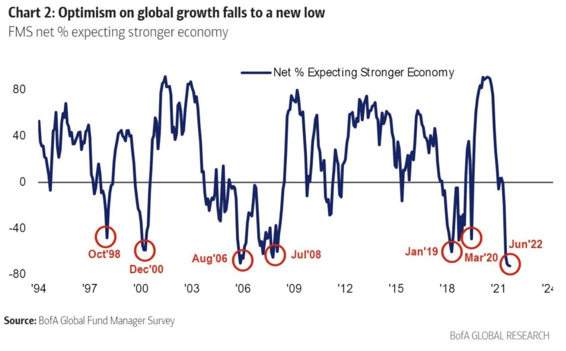

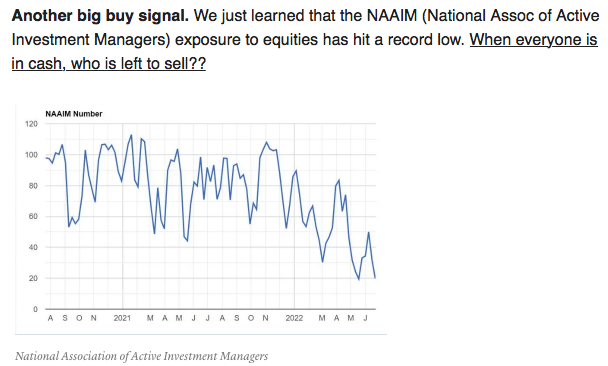

Here are the signs of capitulation:

1) The percent of co’s trading below the value of their cash and short term investments is at an all time high.

2) Optimism on global growth has fallen to an all time low (contrarian signal)

3) The AAII percentage of bulls is at its second highest level on record. The previous peak marked the markets lows in March 2009

4) And this big buy signal…money managers hate stocks.

Decades Long Analytics Point to Strong Second Half

1) AAII Investor Sentiment Survey. We’re coming off of back to back to back (historical readings) with less than 20% bulls (last nights reading was 22.8% bulls). Readings of less than 20% bulls have occurred just 10 x since 1987. Following each reading below 20% bulls, the market (S&P 500) has been higher 100% of the time over the next 6–12 months with avg gains of 13% and 23%.

2) The S&P 500 is down 21% for the year, which is the worst first half to any year since 1970. In previous years where the S&P 500 was down at least 15% through June (going back to 1932) the final six months of the year were higher 100% of the time (5/5) with an average return of 23.7%

3) Going back to 1962 when the previous 6 months took the S&P 500 down more than 15% (combined)…as now, with 21% losses…the next 6 months were then higher 100% of the time (7/7) with an average gain of 17%. Over the next year, the S&P 500 was also higher 100% of the time with an average gain of 29.6%.

VRA Bottom Line:

If there was ever a market facing a “wall of worry” to climb, this is that market. Yes, we are in a bear market and yes, short term moves higher should (likely) be treated as bear market rallies. However, we’ve already fallen 24% in the S&P 500, which is the average bear market decline without a recession. In addition, most stocks have been declining and in a bear market for more than a year with the average stock losing more than 50% in value. This is also our 3rd bear market in 4 years and we should continue to expect everything to keep happening faster, meaning that bear markets can very quickly turned back into bull markets.

I believe most stocks have bottomed, certainly in the VRA Portfolio. As covered above, investor sentiment, analytics and our VRA technicals were so bearish/oversold that we must be bullish.

Granted, the bears are still in control of this market but should the Fed be able to engineer a soft landing we’ll be left with a stock market that’s already been hit hard but without the accompanying recession. Did you see that the semis fell a total of 40% (when they got hit again on Monday). 40% losses in our most important tech sector and leading indicator of global business activity….thats a serious bear market. J Powell, are you paying attention?

We want to see this 2-day pattern of strong afternoons continue and we really want to see the internals begin to improve. They were rather hideous the last 2 days. But as we’ve been covering here often, the first half of 2022 was so brutal…a worst 5 all-time…that investing probabilities and analytics point to a second half should be a barn burner to the upside. Possibly even a bull market within a bear market. Enough to make the bears nervous enough that they start covering their shorts…aggressively. With the midterms approaching, Biden needs at least one thing going for him. I’m pretty sure a quick talk with J Powell could get the stock market moving in the right direction.

Insane EU Energy Agenda

(For the full analysis join us for two free weeks at VRAinsider.com)

Tyler here with you for this part of today’s update.

For years the EU has pursued their climate change agenda. Rejecting all forms of what they see as “unclean energy”. This has left much of Europe vulnerable on the energy front, and they are now on the brink of recession as natural gas prices have soared 700% since the start of last year.

As the energy crisis only appears to be getting worse in Europe, yesterday the EU voted to allow natural gas and nuclear energy to be labeled as green investments.

The legislation does not go into effect until the beginning of next year, but it will allow for much needed cash flows back into natural gas and nuclear energy.

As we have seen time and time again, government intervention causes more problems than it solves.

For example, at the beginning of this year Germany decided to shut down half of their existing nuclear plants. They had planned to decommission all nuclear plants by the end of 2023 and phase out the use of coal by 2030… only to have an energy crisis not even a year later… and so then they decided to classify nuclear as “green energy” again.

Doesn’t it seem backwards to cut out nuclear before they cut out coal? That’s because it is, and it is all part of the scam that is ESG Investing. Now I’m sure those who came up with the ESG idea hoped to bring about a cleaner future. However, as we have learned from history, the road to hell is often paved with good intentions. This latest debacle is a great example.

Here are the facts

Germany has spent over $580 billion dollars on “renewable energies” such as wind and solar since their climate change initiative began. During that time energy prices have risen 51% in Germany (2006–2018).

Studies have now shown that Nuclear energy produces roughly double the amount of energy compared to solar and wind, and for about half of the cost. If Germany had spent the $580 billion on nuclear instead of on “renewable energy” (wind and solar), many believe they would now be producing more clean energy than they needed.

As countries like France have proven, nuclear power is a fantastic, low-cost, low-carbon energy option that is crucial to the future of energy production. Unlike Germany, France has continued to be a leader in the use of nuclear power. France got roughly 2.2% of its energy from coal as of 2020. While Germany got 28.8% of its energy from coal in 2021.

France now generates 2X more electricity from clean energy than Germany, and France pays about half as much for electricity compared to Germany.

Not only is Germany rushing to extend the life of nuclear plants, but European countries are now being forced to bring coal plants back online.

Clearly this isn’t really about creating a cleaner environment for future generations is it? No, ESG is a scam intended to funnel money from the energy markets into the pockets of ESG investment managers. Instead of providing affordable energy, climate czars are padding their pockets.

Unfortunately, Germany and most of Europe are running out of time to implement these measures.

Now they have to resort to last ditch efforts like reopening coal plants as Germany says, “gas shortfalls could trigger a Lehman Brothers-like collapse, as Europe’s economic powerhouse faces the unprecedented prospect of businesses and consumers running out of power. The main Nord Stream pipeline that carries Russian gas to Germany is due to shut down on July 11 for ten days of maintenance, and there’s growing fear that Moscow may not reopen it.”

If only there was someone who could have warned them years ago that Europe’s reliance on Russian energy was a crisis in the making… Oh yeah, Trump did that 4 years ago and the German’s laughed at him.

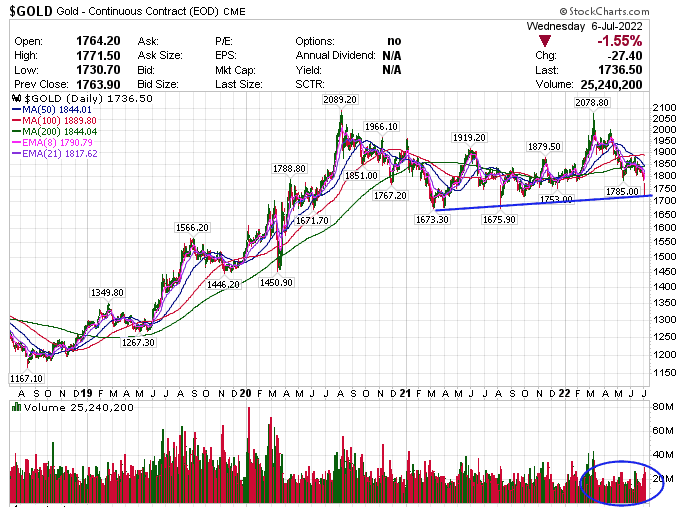

GOLD

Gold has been knocked from near all time highs of $2078 to $1736/ounce over the last 4 months. Likely because inflation is collapsing even as the dollar keeps going higher. Gold has held its value better than most assets but now sits 16% off of its highs. The thinking from gold bears is; if we’re going into a tough recession (without QE on the horizon), “everything” is going lower. Gold has now pulled back to an area of strong support and is hitting heavily oversold on the VRA System. Keep buying physical gold and silver and VRA 10 Baggers. Pullbacks are a gift.

Energy stocks have also pulled back to their 200 dma and are a strong buy here. The chart below of ERX (2 x Energy ETF) makes

clear that we are at solid support, the sell off has been on light volume and we are hitting extreme oversold on VRA System.

Until next time, thanks again for reading…

Kip

Join us for two free weeks at VRAInsider.com

Sign up to join us for our daily VRA Investing System podcast

Also, Find us on Truth Social and Rumble